Pitney Bowes 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

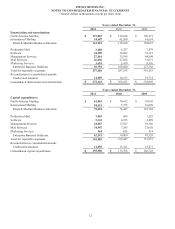

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

82

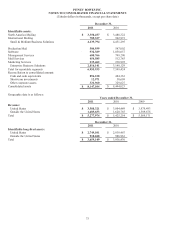

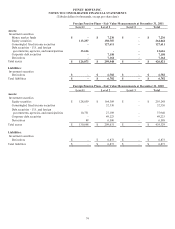

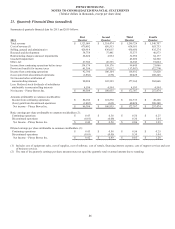

Nonpension Postretirement Benefits

We provide certain health care and life insurance benefits to eligible retirees and their dependents. The cost of these benefits is

recognized over the period the employee provides credited service to the Company. Substantially all of our U.S. and Canadian

employees become eligible for retiree health care benefits after reaching age 55 or in the case of employees of Pitney Bowes

Management Services after reaching age 60 and with the completion of the required service period. U.S. employees hired after

January 1, 2005, and Canadian employees hired after April 1, 2005, are not eligible for retiree health care benefits.

The benefit obligation and funded status for nonpension postretirement benefit plans are as follows:

December 31,

2011 2010

Benefit obligation:

Benefit obligations at beginning of year $ 280,386 $ 254,405

Service cost 3,328 3,724

Interest cost 13,528 13,828

Plan participants’ contributions 8,861 9,182

Actuarial loss 20,792 33,983

Foreign currency changes (648) 1,061

Benefits paid (43,964) (43,563)

Curtailment 3,245 7,575

Special termination benefits 300 191

Benefit obligations at end of year $ 285,828 $ 280,386

Fair value of plan assets:

Fair value of plan assets at beginning of year $ - $ -

Company contribution 35,103 34,381

Plan participants’ contributions 8,861 9,182

Gross benefits paid (43,964) (43,563)

Fair value of plan assets at end of year $ - $ -

Funded status $ (285,828) $ (280,386)

Amounts recognized in the Consolidated Balance Sheets:

Current liability $ (28,855) $ (29,374)

Non-current liability (256,973) (251,012)

Net amount recognized $ (285,828) $ (280,386)

Pre-tax amounts recognized in AOCI consist of:

Net actuarial loss $ 115,713 $ 102,910

Prior service credit (5,696) (5,886)

Total $ 110,017 $ 97,024

(1) The benefit obligation for the United States nonpension postretirement plans was $262 and $259 million December 31, 2011 and

2010