Pitney Bowes 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

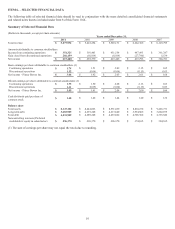

• Further, based on the results of our annual goodwill impairment review process, we recorded additional pre-tax goodwill and

intangible asset impairment charges of $84 million and $5 million, respectively related to the international operations of our

Management Services segment (PBMSi);

• In September 2011, we completed a sale of non-U.S. leveraged lease assets resulting in cash proceeds of $102 million and an

after-tax gain of $27 million.

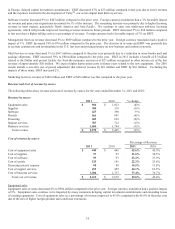

During the year, we entered into a series of settlements with the IRS in connection with its examinations of our tax years 2001-2008

under which we agreed upon both the tax treatment of a number of disputed issues, including issues related to our Capital Services

business that was sold in 2006, and revised tax calculations. As a result of these settlements, we recognized tax benefits of $90

million in income from continuing operations and $264 million in discontinued operations. Our additional liability for tax and interest

arising from the 2001-2008 IRS examinations was approximately $400 million, which was previously paid through the purchase of tax

bonds.

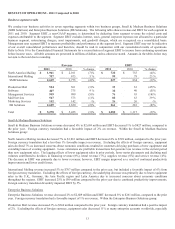

We generated $920 million in cash from operations, which was used primarily to reduce debt by $50 million, repurchase $100 million

of our common stock, pay $300 million of dividends to our common stockholders and fund capital investments of $156 million.

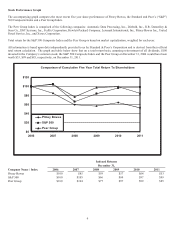

Net income attributable to Pitney Bowes was $617 million, or $3.05 per diluted share and included $266 million, or $1.31 per diluted

share from discontinued operations.

Outlook

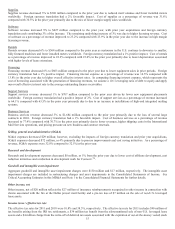

The worldwide economy and business environment continued to be uncertain during 2011 and we believe it will continue to be

uncertain in 2012. We anticipate physical mail volumes will continue their gradual decline as alternative means of communications

evolve and gain further acceptance. As a result, Small and Medium Business Solutions (SMB) revenue growth should continue to be

challenged. We anticipate a gradual improvement in equipment sales in 2012 due, in part, to sales of Connect+TM communications

systems, but a recovery in SMB revenues will lag any recovery in equipment sales. We anticipate revenue growth from increased

demand for multi-year software licensing agreements, increased placements of production print equipment and continued expansion in

Mail Services operations will help offset the anticipated decline in SMB revenues.

We will continue our focus on streamlining our business operations and creating more flexibility in our cost structure. Our growth

strategies will focus on leveraging our expertise in physical communications with our expanding capabilities in digital and hybrid

communications. We will continue to develop and invest in products, software, services and solutions that help customers grow their

business by more effectively managing their physical and digital communications with their customers. Over time, we expect our mix

of revenue to change, with a greater percentage of revenue coming from enterprise related products and solutions. We also expect to

roll out other digitally-based products and services but do not expect them to have a significant impact on our revenues for 2012.