Pitney Bowes 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

44

Rentals Revenue

We rent equipment, primarily postage meters and mailing equipment, under short-term rental agreements, generally for periods of

three months to five years. Rental revenue includes revenue from the subscription for digital meter services. We invoice in advance

for postage meter rentals, at various lengths. We initially defer these advanced billings and recognize rental revenue on a straight-line

basis over the invoice period. We defer certain initial direct costs, primarily personnel-related costs, incurred in consummating a

transaction and recognize these costs over the term of the agreement. Initial direct costs expensed in 2011, 2010 and 2009 were $19

million, $27 million and $25 million, respectively. Initial direct costs, included in rental property and equipment, net on our

Consolidated Balance Sheets, were $31 million and $37 million at December 31, 2011 and 2010, respectively.

Financing Revenue

We provide lease financing for our products primarily through sales-type leases. We also provide revolving lines of credit to our

customers for the purchase of postage and related supplies. The vast majority of our leases qualify as sales-type leases using the

present value of minimum lease payments classification criteria. We believe that our sales-type lease portfolio contains only normal

collection risk. Accordingly, we record the fair value of equipment as sales revenue, the cost of equipment as cost of sales and the

minimum lease payments plus the estimated residual value as finance receivables. The difference between the finance receivable and

the equipment fair value is recorded as unearned income and is amortized as income over the lease term using the interest method.

Revenues generated from financing customers for the continued use of equipment subsequent to the expiration of the original lease

term are classified within financing revenue.

Equipment residual values are determined at inception of the lease using estimates of equipment fair value at the end of the lease term.

Estimates of future equipment fair value are based primarily on our historical experience. We also consider forecasted supply and

demand for our various products, product retirement and future product launch plans, end of lease customer behavior, regulatory

changes, remanufacturing strategies, used equipment markets, if any, competition and technological changes. We evaluate residual

values on an annual basis or as changes to the above considerations occur.

Support Services Revenue

We provide support services for our equipment primarily through maintenance contracts. Revenue related to these agreements is

recognized on a straight-line basis over the term of the agreement, which typically is one to five years.

Business Services Revenue

Business services revenue includes revenue from management services, mail services, and marketing services. Management services,

which includes outsourcing of mailrooms, copy centers, or other document management functions, are typically one to five year

contracts that contain a monthly service fee and in many cases a “click” charge based on the number of copies made, machines in use,

etc. Revenue is recognized over the term of the agreement, based on monthly service charges, with the exception of the “click”

charges, which are recognized as earned. Mail services include the preparation, sortation and aggregation of mail to earn postal

discounts and expedite delivery and revenue is recognized as the services are provided. Marketing services include direct mail

marketing services and revenue is recognized over the term of the agreement as the services are provided.

Shipping and Handling

Shipping and handling costs are recorded in cost of revenues.

Product Warranties

We provide product warranties in conjunction with the sale of certain products, generally for a period of 90 days from the date of

installation. We estimate our liability for product warranties based on historical claims experience and other currently available

evidence. Our product warranty liability at December 31, 2011 and 2010 was not material.

Deferred Marketing Costs

We capitalize certain direct mail, telemarketing, Internet, and retail marketing costs, associated with the acquisition of new customers

and recognize these costs over the expected revenue stream ranging from five to nine years. Deferred marketing costs expensed in

2011, 2010 and 2009 were $34 million, $39 million and $44 million, respectively. Deferred marketing costs, included in other assets

on the Consolidated Balance Sheets, were $84 million and $106 million at December 31, 2011 and 2010, respectively. We review

individual marketing programs for impairment on a periodic basis or as circumstances warrant.

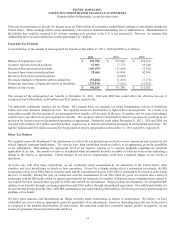

Restructuring Charges

Costs associated with exit or disposal activities and restructurings are recognized when the liability is incurred. The cost and related

liability for one-time benefit arrangements is recognized when the costs are probable and reasonably estimable.