Pitney Bowes 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

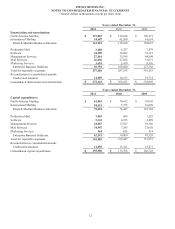

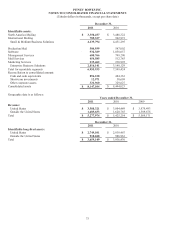

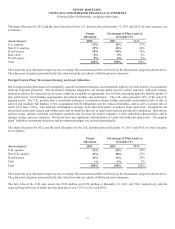

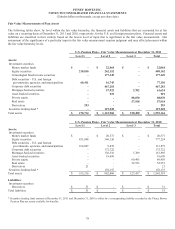

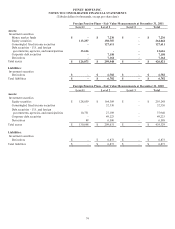

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

70

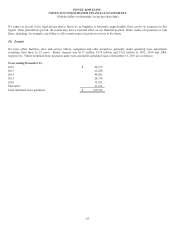

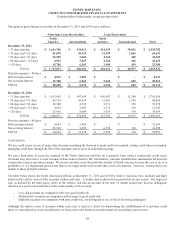

During the year, we completed a sale of non-U.S. leveraged lease assets for cash. The investment in that leveraged lease on the date

of sale was $109 million and an after-tax gain of $27 million was recognized. The effects of the sale are not included in the table

above.

There was no impact on income from leveraged leases in 2011 due to changes in statutory tax rates. Income from leveraged leases

was positively impacted by $2 million and $3 million in 2010 and 2009, respectively, due to changes in statutory tax rates.

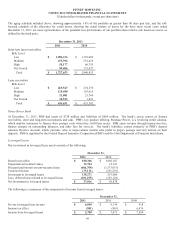

In February 2012, we signed an agreement to sell certain leveraged lease assets to the lessee. The investment in these leveraged lease

assets at December 31, 2011 was $109 million. In connection with this transaction, we expect to recognize an after-tax gain, which

will be finalized in the first quarter of 2012.

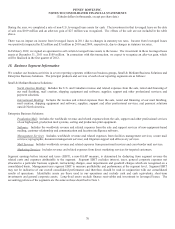

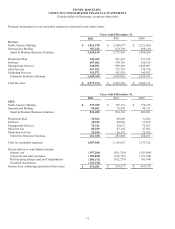

18. Business Segment Information

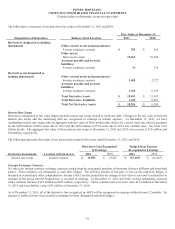

We conduct our business activities in seven reporting segments within two business groups, Small & Medium Business Solutions and

Enterprise Business Solutions. The principal products and services of each of our reporting segments are as follows:

Small & Medium Business Solutions:

North America Mailing: Includes the U.S. and Canadian revenue and related expenses from the sale, rental and financing of

our mail finishing, mail creation, shipping equipment and software; supplies; support and other professional services; and

payment solutions.

International Mailing: Includes the revenue and related expenses from the sale, rental and financing of our mail finishing,

mail creation, shipping equipment and software; supplies; support and other professional services; and payment solutions

outside North America.

Enterprise Business Solutions:

Production Mail: Includes the worldwide revenue and related expenses from the sale, support and other professional services

of our high-speed, production mail systems, sorting and production print equipment.

Software: Includes the worldwide revenue and related expenses from the sale and support services of non-equipment-based

mailing, customer relationship and communication and location intelligence software.

Management Services: Includes worldwide revenue and related expenses from facilities management services; secure mail

services; reprographic, document management services; and litigation support and eDiscovery services.

Mail Services: Includes worldwide revenue and related expenses from presort mail services and cross-border mail services.

Marketing Services: Includes revenue and related expenses from direct marketing services for targeted customers.

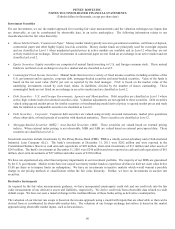

Segment earnings before interest and taxes (EBIT), a non-GAAP measure, is determined by deducting from segment revenue the

related costs and expenses attributable to the segment. Segment EBIT excludes interest, taxes, general corporate expenses not

allocated to a particular business segment, restructuring charges, asset impairments and goodwill charges which are recognized on a

consolidated basis. Management uses segment EBIT to measure profitability and performance at the segment level. Segment EBIT

may not be indicative of our overall consolidated performance and therefore, should be read in conjunction with our consolidated

results of operations. Identifiable assets are those used in our operations and exclude cash and cash equivalents, short-term

investments and general corporate assets. Long-lived assets exclude finance receivables and investment in leveraged leases. The

accounting policies of the segments are the same as those described in Note 1.