Pitney Bowes 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

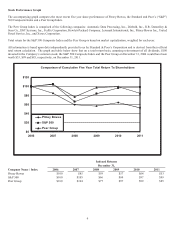

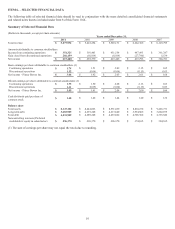

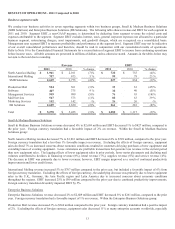

RESULTS OF OPERATIONS - 2011 Compared to 2010

Business segment results

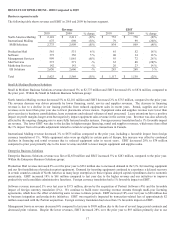

We conduct our business activities in seven reporting segments within two business groups, Small & Medium Business Solutions

(SMB Solutions) and Enterprise Business Solutions (EB Solutions). The following table shows revenue and EBIT for each segment in

2011 and 2010. Segment EBIT, a non-GAAP measure, is determined by deducting from segment revenue the related costs and

expenses attributable to the segment. Segment EBIT excludes interest, taxes, general corporate expenses not allocated to a particular

business segment, restructuring charges, asset impairments, and goodwill charges, which are recognized on a consolidated basis.

Management uses segment EBIT to measure profitability and performance at the segment level. Segment EBIT may not be indicative

of our overall consolidated performance and therefore, should be read in conjunction with our consolidated results of operations.

Refer to Note 18 to the Consolidated Financial Statements for a reconciliation of segment EBIT to income from continuing operations

before income taxes. All table amounts are presented in millions of dollars, unless otherwise stated. Amounts in the tables below may

not sum to the total due to rounding.

Revenue EBIT

2011 2010 % change 2011 2010 % change

North America Mailing $ 1,961 $ 2,101 (7)% $ 728 $ 755 (4)%

International Mailing 707 675 5 % 99 79 25 %

SMB Solutions 2,669 2,775 (4)% 827 834 (1)%

Production Mail 544 561 (3)% 33 61 (47)%

Software 407 375 9 % 38 40 (5)%

Management Services 949 999 (5)% 76 93 (18)%

Mail Services 567 573 (1)% 88 63 39 %

Marketing Services 142 142 -% 26 26 -%

EB Solutions 2,609 2,650 (2)% 261 283 (8)%

Total $ 5,278 $ 5,425 (3)% $ 1,088 $ 1,117 (3)%

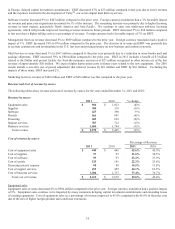

Small & Medium Business Solutions

Small & Medium Business Solutions revenue decreased 4% to $2,669 million and EBIT decreased 1% to $827 million, compared to

the prior year. Foreign currency translation had a favorable impact of 2% on revenue. Within the Small & Medium Business

Solutions group:

North America Mailing revenue decreased 7% to $1,961 million and EBIT decreased 4% to $728 million, compared to the prior year.

Foreign currency translation had a less than 1% favorable impact on revenue. Excluding the effects of foreign currency, equipment

sales declined 7% as increased concerns about economic conditions resulted in customers delaying purchases of new equipment and

extending leases of existing equipment. Lease extensions are profitable transactions but generate less revenue in the current period

than new equipment sales. The lagging effects of lower equipment sales in prior periods, fewer meter placements and declining mail

volumes contributed to declines in financing revenue (8%), rental revenue (7%), supplies revenue (8%) and service revenue (4%).

The decrease in EBIT was primarily due to lower revenues; however, EBIT margin improved as a result of continued productivity

improvements and lower credit losses.

International Mailing revenue increased 5% to $707 million compared to the prior year, but included a favorable impact of 6% from

foreign currency translation. Excluding the effects of foreign currency, the underlying decrease was primarily due to lower equipment

sales in the U.K., Germany, the Asia Pacific region and Latin America due to increased concerns about economic conditions

throughout the regions. EBIT increased 25% to $99 million compared to the prior year due to continued productivity improvements.

Foreign currency translation favorably impacted EBIT by 5%.

Enterprise Business Solutions

Enterprise Business Solutions revenue decreased 2% to $2,609 million and EBIT decreased 8% to $261 million, compared to the prior

year. Foreign currency translation had a favorable impact of 1% on revenue. Within the Enterprise Business Solutions group:

Production Mail revenue decreased 3% to $544 million compared to the prior year. Foreign currency translation had a positive impact

of 2%. Excluding the effects of foreign currency, equipment sales decreased 11% as many enterprise accounts worldwide, especially