Pitney Bowes 2011 Annual Report Download - page 78

Download and view the complete annual report

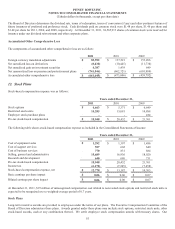

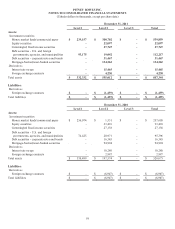

Please find page 78 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

60

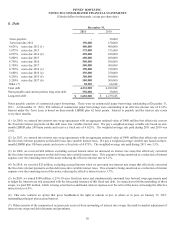

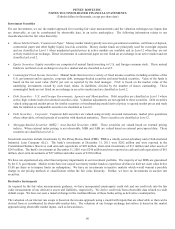

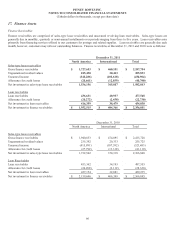

Investment Securities

For our investments, we use the market approach for recurring fair value measurements and the valuation techniques use inputs that

are observable, or can be corroborated by observable data, in an active marketplace. The following information relates to our

classification into the fair value hierarchy:

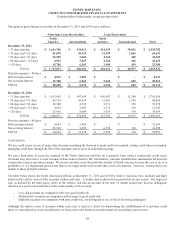

• Money Market Funds / Commercial Paper: Money market funds typically invest in government securities, certificates of deposit,

commercial paper and other highly liquid, low-risk securities. Money market funds are principally used for overnight deposits

and are classified as Level 1 when unadjusted quoted prices in active markets are available and as Level 2 when they are not

actively traded on an exchange. Direct investments in commercial paper are not listed on an exchange in an active market and are

classified as Level 2.

• Equity Securities: Equity securities are comprised of mutual funds investing in U.S. and foreign common stock. These mutual

funds are not listed on an exchange in an active market and are classified as Level 2.

• Commingled Fixed Income Securities: Mutual funds that invest in a variety of fixed income securities including securities of the

U.S. government and its agencies, corporate debt, mortgage-backed securities and asset-backed securities. Value of the funds is

based on the net asset value (NAV) per unit as reported by the fund manager. NAV is based on the market value of the

underlying investments owned by each fund, minus its liabilities, divided by the number of shares outstanding. These

commingled funds are not listed on an exchange in an active market and are classified as Level 2.

• Debt Securities – U.S. and Foreign Governments, Agencies and Municipalities: Debt securities are classified as Level 1 where

active, high volume trades for identical securities exist. Valuation adjustments are not applied to these securities. Debt securities

valued using quoted market prices for similar securities or benchmarking model derived prices to quoted market prices and trade

data for identical or comparable securities are classified as Level 2.

• Debt Securities – Corporate: Corporate debt securities are valued using recently executed transactions, market price quotations

where observable, or bond spreads of securities with identical maturities. These securities are classified as Level 2.

• Mortgage-Backed Securities (MBS) / Asset-Backed Securities (ABS): These securities are valued based on external pricing

indices. When external index pricing is not observable, MBS and ABS are valued based on external price/spread data. These

securities are classified as Level 2.

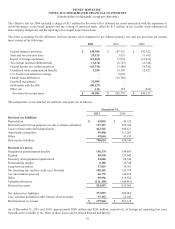

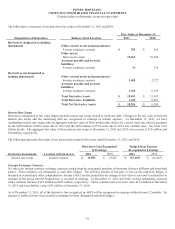

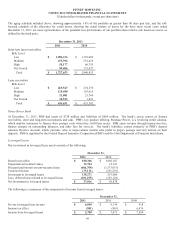

Investment securities include investments by The Pitney Bowes Bank (PBB). PBB is a wholly owned subsidiary and a Utah-chartered

Industrial Loan Company (ILC). The bank’s investments at December 31, 2011 were $282 million and were reported in the

Consolidated Balance Sheets as cash and cash equivalents of $28 million, short-term investments of $11 million and other assets of

$243 million. The bank’s investments at December 31, 2010 were $246 million and were reported as cash and cash equivalents of $61

million, short-term investments of $27 million and other assets of $158 million.

We have not experienced any other than temporary impairments in our investment portfolio. The majority of our MBS are guaranteed

by the U.S. government. Market events have not caused our money market funds to experience declines in their net asset value below

$1.00 per share or to impose limits on redemptions. We have no investments in inactive markets which would warrant a possible

change in our pricing methods or classification within the fair value hierarchy. Further, we have no investments in auction rate

securities.

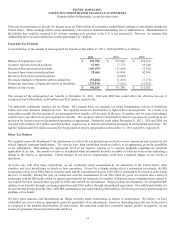

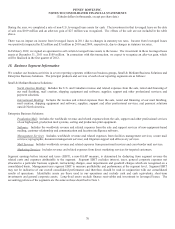

Derivative Instruments

As required by the fair value measurements guidance, we have incorporated counterparty credit risk and our credit risk into the fair

value measurement of our derivative assets and liabilities, respectively. We derive credit risk from observable data related to credit

default swaps. We have not seen a material change in the creditworthiness of those banks acting as derivative counterparties.

The valuation of our interest rate swaps is based on the income approach using a model with inputs that are observable or that can be

derived from or corroborated by observable market data. The valuation of our foreign exchange derivatives is based on the market

approach using observable market inputs, such as forward rates.