Pitney Bowes 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

75

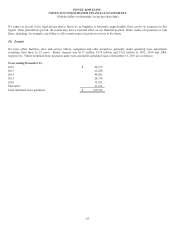

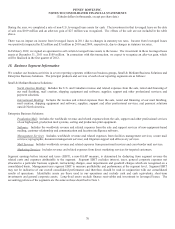

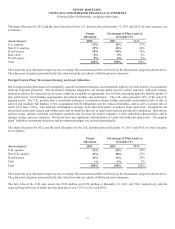

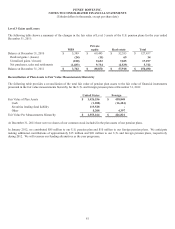

Pre-tax amounts recognized in AOCI consist of:

United States Foreign

2011 2010 2011 2010

Net actuarial loss $ 858,531 $ 719,890 $ 224,731 $ 168,376

Prior service cost 2,159 2,400 541 541

Transition asset - - (273) (282)

Total $ 860,690 $ 722,290 $ 224,999 $ 168,635

The estimated amounts that will be amortized from AOCI into net periodic benefits cost in 2012 are as follows:

Net actuarial loss $ 53,256 $ 13,700

Prior service cost 816 99

Transition asset - (9)

Total $ 54,072 $ 13,790

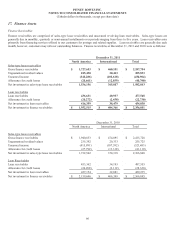

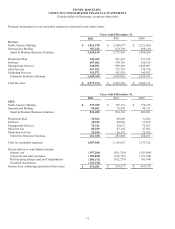

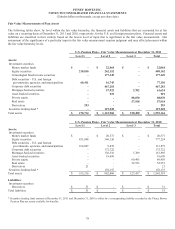

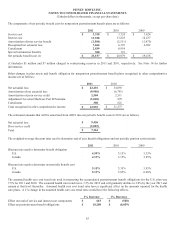

The components of net periodic pension cost for defined benefit pension plans are as follows:

United States Foreign

2011 2010 2009 2011 2010 2009

Service cost $ 19,450 $ 23,157 $ 24,274 $ 7,310 $ 6,907 $ 6,853

Interest cost 87,738 89,602 93,997 28,329 27,507 25,200

Expected return on

plan assets (123,058) (123,095) (120,662)

(31,784)

(28,838)

(27,193)

Amortization of

transition cost - - - (10) (9) (61)

Amortization of prior

service (cost) credit 147 (2,575) (2,547) 170 214 446

Recognized net

actuarial loss 37,522 32,343 26,063 11,135 10,205 2,486

Special termination

benefits 1,489 8,148 112 277 291 2,385

Settlement / curtailment 3,036 10,712 4,107 274 1,285 202

Net periodic

benefit cost (1) $ 26,324 $ 38,292 $ 25,344 $ 15,701 $ 17,562 $ 10,318

(1) Includes $5 million and $17 million charged to restructuring reserves in 2011 and 2010, respectively. See Note 14 for further

information.

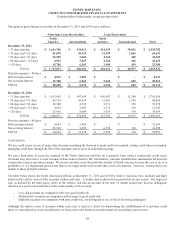

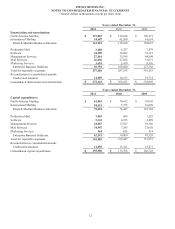

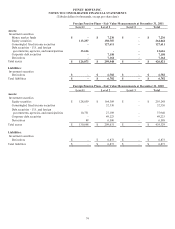

Other changes in plan assets and benefit obligations for defined benefit pension plans recognized in other comprehensive income are

as follows:

United States Foreign

2011 2010 2011 2010

Curtailments effects and settlements $ (95) $ (4,290) $ (274) $ (464)

Net actuarial loss 176,164 13,467 67,934 5,748

Prior service credit - - - (3,790)

Amortization of net actuarial (loss) gain (37,522) (32,343) (11,135) 5,440

Amortization of prior service (cost) credit (147) 2,575 (170) (214)

Net transitional obligation (asset) - - 9 (86)

Total recognized in other

comprehensive income $ 138,400 $ (20,591) $ 56,364 $ 6,634