Pitney Bowes 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

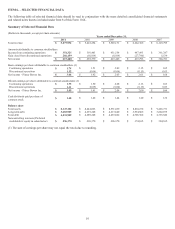

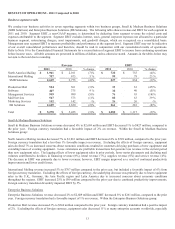

Supplies

Supplies revenue decreased 3% to $308 million compared to the prior year due to reduced mail volumes and fewer installed meters

worldwide. Foreign currency translation had a 2% favorable impact. Cost of supplies as a percentage of revenue was 31.6%

compared with 30.5% in the prior year primarily due to the mix of lower margin supply sales worldwide.

Software

Software revenue increased 9% to $427 million compared to the prior year, with prior year acquisitions and foreign currency

translation each contributing 3% of the increase. The remaining underlying increase of 3% was due to higher licensing revenue. Cost

of software as a percentage of revenue improved to 23.2% compared with 23.9% in the prior year due to the increase in high margin

licensing revenue.

Rentals

Rentals revenue decreased 6% to $564 million compared to the prior year as customers in the U.S. continue to downsize to smaller,

fully featured machines and fewer installed meters worldwide. Foreign currency translation had a 1% positive impact. Cost of rentals

as a percentage of revenue improved to 22.2% compared with 23.6% in the prior year primarily due to lower depreciation associated

with higher levels of lease extensions.

Financing

Financing revenue decreased 6% to $603 million compared to the prior year due to lower equipment sales in prior periods. Foreign

currency translation had a 1% positive impact. Financing interest expense as a percentage of revenue was 14.5% compared with

13.8% in the prior year due to higher overall effective interest rates. In computing financing interest expense, which represents the

cost of borrowing associated with the generation of financing revenues, we assume a 10:1 leveraging ratio of debt to equity and apply

our overall effective interest rate to the average outstanding finance receivables.

Support Services

Support services revenue decreased 1% to $707 million compared to the prior year driven by lower new equipment placements

worldwide. Foreign currency translation had a positive impact of 2%. Cost of support services as a percentage of revenue increased

to 64.1% compared with 63.5% in the prior year primarily due to due to an increase in installations of high-end integrated mailing

systems.

Business Services

Business services revenue decreased 3% to $1,684 million compared to the prior year primarily due to the loss of several large

contracts in 2010. Foreign currency translation had a 1% favorable impact. Cost of business services as a percentage of revenue

increased to 77.4% compared with 76.7% in the prior year primarily due to lower revenues, higher shipping costs in the International

Mail Services operations, and pricing pressure on new business and contract renewals.

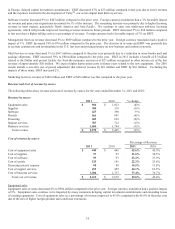

Selling, general and administrative (SG&A)

SG&A expenses decreased $29 million; however, excluding the impacts of foreign currency translation and prior year acquisitions,

SG&A expenses decreased $72 million, or 4% primarily due to process improvements and cost saving initiatives. As a percentage of

revenue, SG&A expenses were 32.8% compared to 32.5% in the prior year.

Research and development

Research and development expenses decreased $8 million, or 5% from the prior year due to lower cost of offshore development, cost

reduction initiatives and a reduction in development work for Connect+TM.

Goodwill and intangible asset impairment

Aggregate goodwill and intangible asset impairment charges were $130 million and $17 million, respectively. The intangible asset

impairment charges are included in restructuring charges and asset impairments in the Consolidated Statements of Income. See

Critical Accounting Estimates in this MD&A and Note 1 to the Consolidated Financial Statements for further details.

Other income, net

Other income, net of $20 million reflects the $27 million of insurance reimbursements recognized in other income in connection with

claims associated with the fire at the Dallas presort mail facility and a pre-tax loss of $7 million on the sale of non-U.S. leveraged

lease assets.

Income taxes / effective tax rate

The effective tax rates for 2011 and 2010 were 10.8% and 38.5%, respectively. The effective tax rate for 2011 includes $90 million of

tax benefits arising from the IRS tax settlements, a $34 million tax benefit from the aforementioned sale of non-U.S. leveraged lease

assets and a $4 million charge from the write-off of deferred tax assets associated with the expiration of out-of-the-money vested stock