Pitney Bowes 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

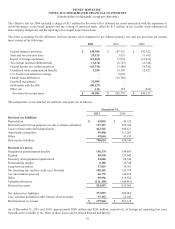

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

54

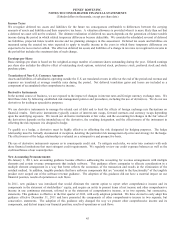

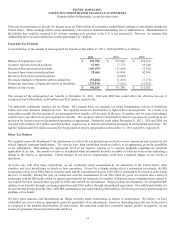

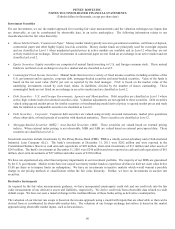

10. Noncontrolling Interests (Preferred Stockholders’ Equity in Subsidiaries)

In 2009, Pitney Bowes International Holdings, Inc. (PBIH), a subsidiary, issued 300,000 shares, or $300 million, of perpetual voting

preferred stock (the Preferred Stock) to certain outside institutional investors. The holders of the Preferred Stock are entitled as a

group to 25% of the combined voting power of all classes of capital stock of PBIH. All outstanding common stock of PBIH,

representing the remaining 75% of the combined voting power of all classes of capital stock, is owned directly or indirectly by the

Company. The Preferred Stock is entitled to cumulative dividends at a rate of 6.125% for a period of seven years after which it

becomes callable and, if it remains outstanding, will yield a dividend that increases by 50% every six months thereafter.

Also in 2009, PBIH redeemed all of the then outstanding 3,750,000 shares of variable term voting preferred stock owned by certain

outside institutional investors for $375 million. These preferred shares were entitled as a group to 25% of the combined voting power

of all classes of capital stock of PBIH. All outstanding common stock of PBIH, representing the remaining 75% of the combined

voting power of all classes of capital stock, was owned directly or indirectly by the Company.

Preferred Stock dividends were $18 million, $18 million and $21 million for the years ended December 31, 2011, 2010 and 2009,

respectively. The dividend amount for 2009 includes an expense of $3 million associated with the redemption of the $375 million

variable term voting preferred stock. No dividends were in arrears at December 31, 2011 or December 31, 2010.

The carrying value of the Preferred Stock is reported as Noncontrolling interests (Preferred stockholders’ equity in subsidiaries) on the

Consolidated Balance Sheets. There was no change in the carrying value of noncontrolling interests during the years ended December

31, 2011 and 2010.

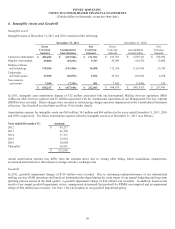

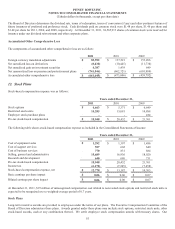

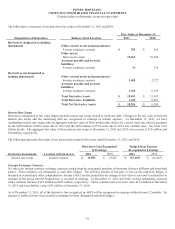

11. Stockholders’ Deficit

At December 31, 2011, 480,000,000 shares of common stock, 600,000 shares of cumulative preferred stock, and 5,000,000 shares of

preference stock were authorized. The following table summarizes the preferred, preference and common stock, net of treasury

shares, outstanding.

Common Stock

Preferred

Stock Preference

Stock Issued Treasury Outstanding

Balance, December 31, 2008 135 36,056 323,337,912 (117,156,719) 206,181,193

Repurchase of common stock - - - -

Issuances of common stock - - - 949,689

Conversions to common stock (50) (3,977) - 66,946

Balance, December 31, 2009 85 32,079 323,337,912 (116,140,084) 207,197,828

Repurchase of common stock - - - (4,687,304)

Issuances of common stock - - - 876,794

Conversions to common stock - (4,296) - 43,684

Balance, December 31, 2010 85 27,783 323,337,912 (119,906,910) 203,431,002

Repurchase of common stock - - - (4,692,200)

Issuances of common stock - - - 963,448

Conversions to common stock - (3,447) - 48,820

Balance, December 31, 2011 85 24,336 323,337,912 (123,586,842) 199,751,070

The preferred stock (4% preferred stock) is entitled to cumulative dividends at a rate of $2 per year and can be converted into 24.24

shares of common stock, subject to adjustment in certain events. The 4% preferred stock is redeemable at our option at a price of $50

per share, plus dividends accrued through the redemption date. At December 31, 2011, there were 2,060 shares of common stock

reserved for issuance upon conversion of the 4% preferred stock.

The preference stock ($2.12 preference stock) is entitled to cumulative dividends at a rate of $2.12 per year and can be converted into

16.53 shares of common stock, subject to adjustment in certain events. The $2.12 preference stock is redeemable at our option at a

price of $28 per share. At December 31, 2011, there were 402,274 shares of common stock reserved for issuance upon conversion of

the $2.12 preference stock.