Pitney Bowes 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

67

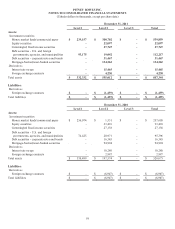

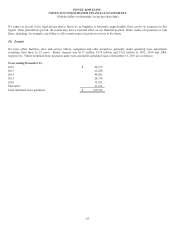

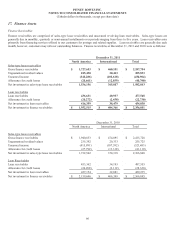

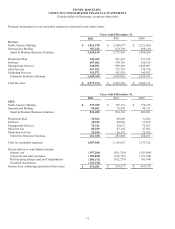

Maturities of gross finance receivables at December 31, 2011 were as follows:

Sales-type Lease Receivables Loan Receivables

North

America International Total North

America International Total

2012 $ 737,813 $ 118,938 $ 856,751 $ 436,631 $ 40,937 $

477,568

2013 492,477 105,440 597,917 - - -

2014 299,965 92,832 392,797 - - -

2015 151,598 73,762 225,360 - - -

2016 44,487 60,666 105,153 - - -

Thereafter 1,313 8,463 9,776 - - -

Total $

1,727,653 $ 460,101 $

2,187,754 $ 436,631 $ 40,937 $

477,568

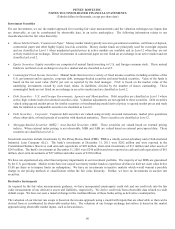

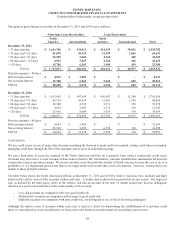

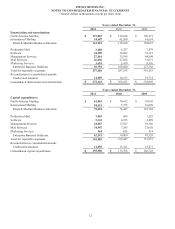

Activity in the allowance for credit losses for finance receivables for each of the three years ended December 31, 2011, 2010 and 2009

is as follows:

Allowance for Credit Losses

Sales-type Lease Receivables Loan Receivables

North

America International

North

America International Total

Balance January 1, 2009 $ 31,182 $ 12,232 $ 25,759 $ 2,617 $ 71,790

Amounts charged to expense 19,067 8,674 32,007 2,007 61,755

Accounts written off (19,244) (7,829) (31,927) (2,387) (61,387)

Balance December 31, 2009 31,005 13,077 25,839 2,237 72,158

Amounts charged to expense 13,211 6,719 20,046 2,024 42,000

Accounts written off (16,424) (6,478) (19,677) (2,149) (44,728)

Balance December 31, 2010 27,792 13,318 26,208 2,112 69,430

Amounts charged to expense 13,726 5,087 7,631 1,610 28,054

Accounts written off (12,857) (6,366) (13,567) (1,264) (34,054)

Balance December 31, 2011 $ 28,661 $ 12,039 $ 20,272 $ 2,458 $ 63,430

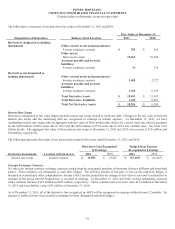

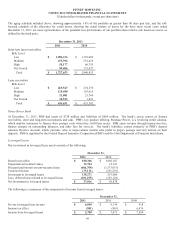

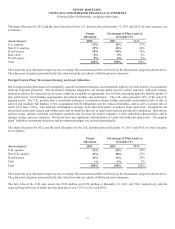

We maintain a program for U.S. borrowers in our North America loan portfolio who are experiencing financial difficulties, but are

able to make reduced payments over an extended period of time. Upon acceptance into the program, the borrower’s credit line is

closed, interest accrual is suspended, the borrower’s minimum required payment is reduced and the account is re-aged and classified

as current. There is generally no forgiveness of debt or reduction of balances owed. The loans in the program are considered to be

troubled debt restructurings because of the concessions granted to the borrower. At December 31, 2011 and 2010, loans in this

program had a balance of $7 million.

The allowance for credit losses for these modified loans is determined by the difference between cash flows expected to be received

from the borrower discounted at the original effective rate and the carrying value of the loan. The allowance for credit losses related

to such loans was $2 million and $1 million at December 31, 2011 and 2010, respectively, and is included in the balance of the

allowance for credit losses of North American loans in the table above. Management believes that the allowance for credit losses is

adequate for these loans and all other loans in the portfolio. Write-offs of loans in the program were $1 million in each of the years

ended December 31, 2011 and 2010, respectively.