Pep Boys 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

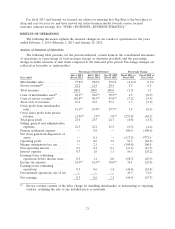

As a result of the foregoing, we reported net earnings of $12.8 million for fiscal 2012 as compared

to net earnings of $28.9 million for fiscal 2012. Our diluted earnings per share were $0.24 as compared

to $0.54 in the prior year period.

Discontinued Operations

The analysis of our results of continuing operations excludes the operating results of closed stores,

where the customer base could not be maintained, which have been classified as discontinued

operations for all periods presented.

Industry Comparison

We operate in the U.S. automotive aftermarket, which has two general lines of business: (1) the

Service business, defined as Do-It-For-Me (service labor, installed merchandise and tires) and (2) the

Retail business, defined as Do-It-Yourself (retail merchandise) and commercial. Generally, specialized

automotive retailers focus on either the Service or Retail area of the business. We believe that

operation in both the Service and Retail areas differentiates us from our competitors. Although we

manage our store performance at a store level in the aggregate, we believe that the following

presentation, which includes the reclassification of revenue from merchandise that we install in

customer vehicles to service center revenue, shows an accurate comparison against competitors within

the two sales arenas. We compete in the Retail area of the business through our retail sales floor and

commercial sales business. Our Service Center business competes in the Service area of the industry.

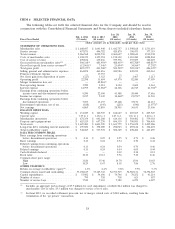

The following table presents the revenues and gross profit for each area of the business.

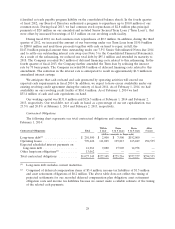

Fiscal Year ended

February 1, February 2, January 28,

(dollar amounts in thousands) 2014 2013 2012

Service center revenue(1) ................ $1,110,958 $1,095,284 $1,038,714

Retail sales(2) ........................ 955,610 995,446 1,024,913

Total revenues ....................... $2,066,568 $2,090,730 $2,063,627

Gross profit from service center revenue(3) . . . $ 209,853 $ 208,795 $ 220,314

Gross profit from retail sales(4) ............ 277,524 282,705 289,213

Total gross profit ...................... $ 487,377 $ 491,500 $ 509,527

(1) Includes revenues from installed products.

(2) Excludes revenues from installed products.

(3) Gross profit from service center revenue includes the cost of installed products sold,

buying, warehousing, service center payroll and related employee benefits and service

center occupancy costs. Occupancy costs include utilities, rents, real estate and property

taxes, repairs and maintenance and depreciation and amortization expenses.

(4) Gross profit from retail sales includes the cost of products sold, buying, warehousing and

store occupancy costs. Occupancy costs include utilities, rents, real estate and property

taxes, repairs and maintenance and depreciation and amortization expenses.

CAPITAL & LIQUIDITY

Capital Resources and Needs

Our cash requirements arise principally from (i) the purchase of inventory and capital expenditures

related to existing and new stores, offices and distribution centers, (ii) debt service and (iii) contractual

26