Pep Boys 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

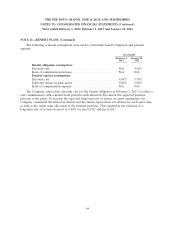

NOTE 16—FAIR VALUE MEASUREMENTS (Continued)

value hierarchy. Measurements of assets held and used are discussed in Note 11, ‘‘Store Closures and

Asset Impairments.’’

NOTE 17—LEGAL MATTERS

The Company is party to a consent decree, effective July 15, 2010, with the United States

Environmental Protection Agency (‘‘EPA’’) that, among other things, required the Company to

implement a formal compliance program with respect to certain small gasoline engine merchandise sold

by the Company. In the fourth quarter of fiscal 2013, the EPA alleged, in writing, that the Company

had violated certain inspection, testing and reporting requirements of the Consent Decree and made an

aggregated stipulated penalty demand of $2.3 million as a result thereof. The Company is currently

engaged in settlement negotiations with the EPA with respect thereto. The Company has accrued an

amount that it believes is sufficient to resolve those violations for which it believes it is liable. If the

Company is unable to resolve all of the violations with the EPA through its settlement negotiations, the

Company intends to invoke formal dispute resolution procedures with the EPA under the terms of the

Consent Decree.

The Company is also party to various actions and claims arising in the normal course of business.

The Company believes that amounts accrued for awards or assessments in connection with all such

matters are adequate and that the ultimate resolution of these matters will not have a material adverse

effect on the Company’s financial position. However, there exists a possibility of loss in excess of the

amounts accrued, the amount of which cannot currently be estimated. While the Company does not

believe that the amount of such excess loss will be material to the Company’s financial position, any

such loss could have a material adverse effect on the Company’s results of operations in the period(s)

during which the underlying matters are resolved.

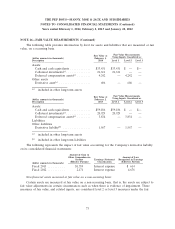

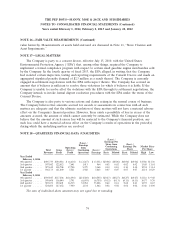

NOTE 18—QUARTERLY FINANCIAL DATA (UNAUDITED)

(Loss) /

Earnings Per

(Loss) / Share from (Loss) /

Earnings Continuing Earnings Per Market Price

Operating from Operations Share Per Share

Total Gross (Loss) / Continuing (Loss) /

Revenues Profit Profit Operations Earnings Basic Diluted Basic Diluted High Low

Year Ended

February 1, 2014

4th quarter ...... $495,733 $104,016 $ (6,614) $ (3,267) $ (3,331) $(0.06) $(0.06) $(0.06) $(0.06) $13.86 $11.36

3rd quarter ...... 507,042 122,812 7,641 1,013 964 0.02 0.02 0.02 0.02 13.05 11.01

2nd quarter ...... 527,619 138,708 17,748 5,379 5,368 0.10 0.10 0.10 0.10 12.94 11.14

1st quarter ...... 536,173 121,840 3,521 3,928 3,863 0.07 0.07 0.07 0.07 12.14 10.29

Year Ended

February 2, 2013

4th quarter ...... $530,847 $117,206 $(16,394) $(14,320) $(14,543) $(0.27) $(0.27) $(0.27) $(0.27) $11.16 $ 9.48

3rd quarter ...... 509,608 116,040 3,791 (6,695) (6,759) (0.13) (0.13) (0.13) (0.13) 10.57 8.76

2nd quarter ...... 525,671 130,601 16,315 33,034 33,048 0.62 0.61 0.62 0.61 14.93 8.67

1st quarter ...... 524,604 127,652 7,940 1,134 1,062 0.02 0.02 0.02 0.02 15.46 14.90

The sum of individual share amounts may not equal due to rounding.

74