Pep Boys 2013 Annual Report Download - page 103

Download and view the complete annual report

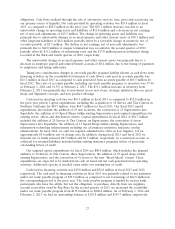

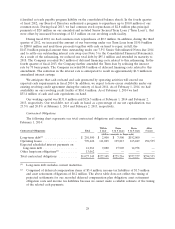

Please find page 103 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.calculations. During the current fiscal year, in connection with the acquisitions discussed in Note 2, we

assumed additional lease obligations totaling $17.4 million over an average of 10 years. Total operating

lease commitments as of February 1, 2014 were $770.6 million.

Pension and Retirement Plans

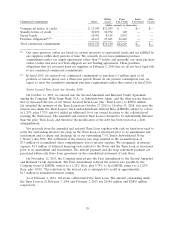

On December 31, 2008, we paid $14.4 million to terminate the defined benefit portion of our

Supplemental Executive Retirement Plan (SERP) and recorded a $6.0 million settlement charge. We

continue to maintain the non-qualified defined contribution portion of the SERP plan (the ‘‘Account

Plan’’) for key employees designated by the Board of Directors. On January 31, 2014, the Account Plan

was amended to eliminate the retirement plan contributions that have historically been made by the

Company effective for calendar year 2015. Our contribution expense for the Account Plan was

$0.8 million, $0.1 million and $0.3 million for fiscal 2013, 2012 and 2011, respectively.

We have a qualified 401(k) savings plan and a separate savings plan for employees residing in

Puerto Rico, which cover all full-time employees who are at least 21 years of age with one or more

years of service. We contribute the lesser of 50% of the first 6% of a participant’s contributions or 3%

of the participant’s compensation. For fiscal 2012 and 2011, our contributions were conditional upon

the achievement of certain pre-established financial performance goals which were not met in fiscal

2012 or 2011. Employer contributions for fiscal 2013 were not conditional on any financial performance

goals. Our savings plans’ contribution expense was $3.5 million in fiscal 2013.

During the fourth quarter of fiscal 2012, the Company terminated its defined benefit pension plan

and contributed $14.1 million to fully fund the plan on a termination basis. Accordingly, the Company

has no further defined benefit pension expense.

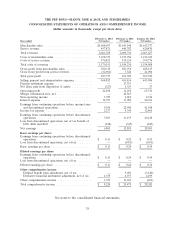

The expense under these plans for fiscal 2013, 2012 and 2011 was $4.3 million, $19.3 million and

$1.4 million, respectively. See Note 13 of the Notes to Consolidated Financial Statements in

‘‘Item 8 Financial Statements and Supplementary Data’’ for further discussion of our pension plans.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

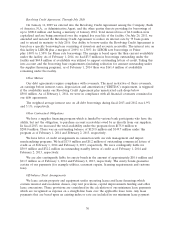

Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses

our consolidated financial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States of America. The preparation of these financial

statements requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and the amounts of revenues and expenses during the reporting period. On an

on-going basis, management evaluates its estimates and judgments, including those related to customer

incentives, product returns and warranty obligations, bad debts, inventories, income taxes, financing

operations, retirement benefits, share-based compensation, risk participation agreements, contingencies

and litigation. Management bases its estimates and judgments on historical experience and on various

other factors that are believed to be reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these estimates under different

assumptions or conditions.

We believe that the following represent our more critical estimates and assumptions used in the

preparation of the consolidated financial statements:

• Inventory is stated at lower of cost, as determined under the last-in, first-out (LIFO) method, or

market. Our inventory, which consists primarily of automotive parts and accessories, is used on

vehicles. Because of the relatively long lives of vehicles, along with our historical experience of

returning most excess inventory to our suppliers for full credit, the risk of obsolescence is

31