Pep Boys 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

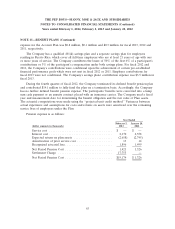

NOTE 14—EQUITY COMPENSATION PLANS (Continued)

The Company reflects in its consolidated statement of cash flows any tax benefits realized upon

the exercise of stock options or issuance of RSUs in excess of that which is associated with the expense

recognized for financial reporting purposes. The amounts reflected as financing cash inflows and

operating cash outflows in the Consolidated Statement of Cash Flows for fiscal 2013, 2012 and 2011 are

immaterial.

During fiscal 2011, the Company began an employee stock purchase plan which provides eligible

employees the opportunity to purchase shares of the Company’s stock at a stated discount through

regular payroll deductions. The aggregate number of shares of common stock that may be issued or

transferred under the plan is 2,000,000 shares. All shares purchased by employees under this plan will

be issued through treasury stock. The Company’s expense for the discount during fiscal years 2013 and

2012 was immaterial. As of February 1, 2014, there were 1,875,753 shares available for issuance under

this plan.

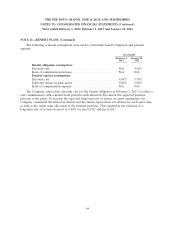

NOTE 15—INTEREST RATE SWAP AGREEMENT

In the third quarter of fiscal 2012, the Company settled its interest rate swap designated as a cash

flow hedge on $145.0 million of the Company’s Term Loan prior to its amendment and restatement.

The swap was used to minimize interest rate exposure and overall interest costs by converting the

variable component of the total interest rate to a fixed rate of 5.036%. Since February 1, 2008, this

swap was deemed to be fully effective and all adjustments in the interest rate swap’s fair value were

recorded to accumulated other comprehensive loss. The settlement of this swap resulted in an interest

charge of $7.5 million, which was previously recorded within accumulated other comprehensive loss.

Immediately subsequent to the previous interest rate swap’s settlement, on October 11, 2012, the

Company entered into two new interest rate swaps for a notional amount of $50.0 million each that

together are designated as a cash flow hedge on the first $100.0 million of the amended and restated

Term Loan. The interest rate swaps convert the variable LIBOR portion of the interest payments due

on the first $100.0 million of the Term Loan to a fixed rate of 1.855%. As of February 1, 2014 and

February 2, 2013, the fair value of the new swap was a net $0.6 million asset and a net $1.6 million

payable, respectively, recorded within other long-term assets or other long-term liabilities on the

balance sheet.

The Company’s refinancing of the $200.0 million Term Loan on November 12, 2013, which lowered

the interest rate payable by the Company from LIBOR, subject to a 1.25% floor plus 3.75%, to

LIBOR, subject to a 1.25% floor plus 3.00%, had no impact on the Company’s interest rate swap or

hedge accounting.

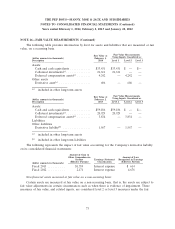

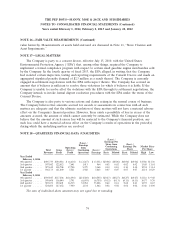

NOTE 16—FAIR VALUE MEASUREMENTS

The Company’s fair value measurements consist of (a) non-financial assets and liabilities that are

recognized or disclosed at fair value in the Company’s financial statements on a recurring basis (at least

annually) and (b) all financial assets and liabilities.

Fair value is defined as the exit price, or the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants as of the measurement

date. There is a hierarchy for inputs used in measuring fair value that maximizes the use of observable

71