Pep Boys 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

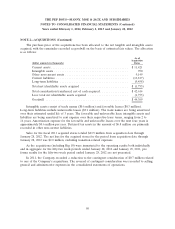

NOTE 2—ACQUISITIONS (Continued)

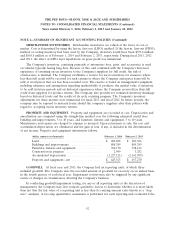

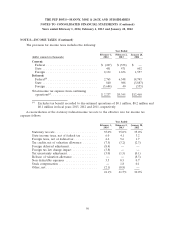

The purchase price of the acquisitions has been allocated to the net tangible and intangible assets

acquired, with the remainder recorded as goodwill on the basis of estimated fair values. The allocation

is as follows:

As of

Acquisition

(dollar amounts in thousands) Dates

Current assets ............................................ $11,421

Intangible assets .......................................... 950

Other non-current assets .................................... 9,149

Current liabilities ......................................... (13,817)

Long-term liabilities ....................................... (9,458)

Total net identifiable assets acquired ........................... $ (1,755)

Total consideration transferred, net of cash acquired ................ $42,614

Less: total net identifiable assets acquired ....................... (1,755)

Goodwill ............................................... $44,369

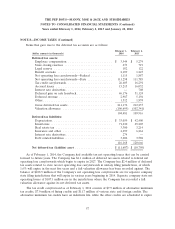

Intangible assets consist of trade names ($0.6 million) and favorable leases ($0.3 million).

Long-term liabilities include unfavorable leases ($9.1 million). The trade names are being amortized

over their estimated useful life of 3 years. The favorable and unfavorable lease intangible assets and

liabilities are being amortized to rent expense over their respective lease terms, ranging from 2 to

16 years. Amortization expense for the favorable and unfavorable leases over the next four years is

approximately $0.6 million per year. Deferred tax assets in the amount of $6.8 million are primarily

recorded in other non-current liabilities.

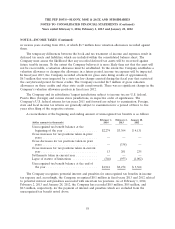

Sales for the fiscal 2011 acquired stores totaled $63.9 million from acquisition date through

January 28, 2012. The net loss for the acquired stores for the period from acquisition date through

January 28, 2012 was $2.0 million, excluding transition related expenses.

As the acquisitions (including Big 10) were immaterial to the operating results both individually

and in aggregate for the fifty-two week periods ended January 28, 2012 and January 29, 2011, pro

forma results for the fifty-two week period ended January 28, 2012 are not presented.

In 2011, the Company recorded a reduction to the contingent consideration of $0.7 million related

to one of the Company’s acquisitions. The reversal of contingent consideration was recorded to selling,

general and administrative expenses in the consolidated statements of operations.

50