Pep Boys 2013 Annual Report Download - page 115

Download and view the complete annual report

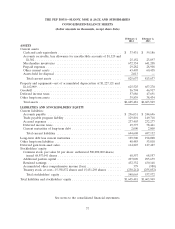

Please find page 115 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

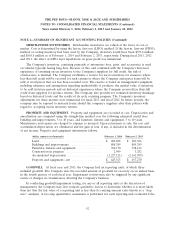

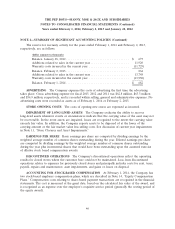

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

qualitative assessment indicates that the carrying value more likely than not exceeds the fair value of

the reporting unit, or if a qualitative assessment is not performed.

The first step of the quantitative evaluation is to compare the fair value of a reporting unit with its

carrying amount. If the carrying amount of a reporting unit exceeds its fair value, the second step of

the impairment test must be performed in order to determine the amount of impairment loss, if any.

The second step compares the implied fair value of reporting unit goodwill with the carrying amount of

that goodwill. If the carrying amount of reporting unit goodwill exceeds the implied fair value of that

goodwill, an impairment loss is recognized in an amount equal to the excess. The loss recognized

cannot exceed the carrying amount of goodwill. The implied fair value of goodwill is determined in the

same manner that the amount of goodwill recognized in a business combination is determined. The

Company allocates the fair value of a reporting unit to all of the assets and liabilities of that unit,

including intangible assets. Any excess of the value of a reporting unit over the amounts assigned to its

assets and liabilities is the implied fair value of goodwill. A deterioration of macroeconomic conditions

may not only negatively impact the estimated operating cash flows used in the Company’s cash flow

models, but may also negatively impact other assumptions used in the Company’s analyses, including,

but not limited to, the estimated cost of capital and/or discount rates. Additionally, in accordance with

accounting guidance, the Company is required to ensure that assumptions used to determine fair value

in the analyses are consistent with the assumptions a market participant would use. As a result, the cost

of capital and/or discount rates used may increase or decrease based on market conditions and trends,

regardless of whether the Company’s cost of capital has changed. Therefore the Company may

recognize an impairment even though cash flows are approximately the same or greater than forecasted

amounts.

There were no impairments as a result of the Company’s annual tests in the fourth quarter of

fiscal year 2013, fiscal year 2012, and fiscal year 2011.

OTHER INTANGIBLE ASSETS The Company amortizes intangible assets with finite lives on a

straight-line basis over their estimated useful lives.

LEASES The Company amortizes leasehold improvements over the lesser of the lease term or

the economic life of those assets. Generally, for stores the lease term is the base lease term and for

distribution centers the lease term includes the base lease term plus certain renewal option periods for

which renewal is reasonably assured and for which failure to exercise the renewal option would result

in an economic penalty to the Company. The calculation of straight-line rent expense is based on the

same lease term with consideration for step rent provisions, escalation clauses, rent holidays and other

lease concessions. The Company begins expensing rent upon completion of the Company’s due

diligence or when the Company has the right to use the property, whichever comes earlier.

SOFTWARE CAPITALIZATION The Company capitalizes certain direct development costs

associated with internal-use software, including external direct costs of material and services, and

payroll costs for employees devoting time to the software projects. These costs are amortized over a

period not to exceed five years beginning when the asset is substantially ready for use. Costs incurred

during the preliminary project stage, as well as maintenance and training costs are expensed as

incurred.

43