Pep Boys 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

volition. As consideration for such restrictive covenants, the Non-Competition Agreements provide for a severance

payment to be made to a named executive officer if he is terminated by the Company without “cause.”

These agreements are fully described in “Employment Agreements with Named Executive Officers”below.

Recoupment Policy (“Clawback”). We will seek to recover, at the direction of the Compensation Committee, all

or a portion of any compensation awarded or paid to a current or former Officer during the prior three fiscal years if

(i) the amount of such compensation was based on the achievement of certain financial results that were subsequently

the subject of a restatement due to the material noncompliance of the Company with any financial reporting

requirement under the securities laws and (ii) a lower award or payment would have been made to the Officer based

upon the restated financial results. If, however, the Compensation Committee determines that an Officer engaged in

misconduct that resulted in the obligation to restate or knew or should have known of such misconduct and failed to

take appropriate action, then we will seek to recover the related compensation regardless of the fiscal year in which it

was paid.

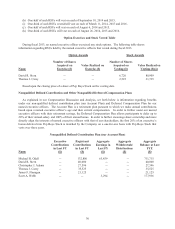

Share Ownership Guidelines. Our Officers are expected to hold shares equal to the following multiples of their

annual salary:

Title Multiple of Annual Salary

President & CEO 5x

Executive Vice President 3x

Senior Vice President 2x

The share ownership levels may be satisfied through direct share ownership and/or by holding unvested time-

based RSUs and vested “in the money” stock options. Officers have five years from the later of their appointment to

their then current position or the establishment of a higher ownership threshold for their position (as described

above) to achieve their expected ownership levels. If in a shortfall position, (i) an officer may not sell Pep Boys

Stock, (ii) all net after-tax shares acquired upon the exercise of stock options or the vesting of RSUs or PSUs must

be retained and (iii) any short-term incentive award in excess of the “cash cap” level will be awarded in the form of

RSUs. All of our named executive officers are either at their expected ownership level or are making the appropriate

progress thereto based upon their time in position. In fiscal 2013, no named executive officer in a shortfall position

disposed of Pep Boys Stock in violation of our share ownership guidelines.

Anti-hedging/pledging Policy. Our Officers and Directors are prohibited from entering into contracts,

instruments or other transactions or purchasing securities (a) designed to hedge against their Company stock

holdings, (b) that derive their value with or in relation to the price of a share of Company stock (except for

transactions under Company Stock Incentive Plans) or (c) that utilize Company stock in a margin account or pledge

arrangement.

Tax and Accounting Matters. We consider the tax and accounting impact of each element of compensation in

determining the appropriate compensation structure. For tax purposes, annual compensation payable to the named

executive officers generally must not exceed $1 million in the aggregate during any year to be fully deductible under

Section 162(m) of the Internal Revenue Code. The Stock Incentive Plan is currently structured with the intention

that stock option grants and performance-based RSUs will qualify as “performance based” compensation that is not

subject to the $1 million deduction limit under Section 162(m). In order to compete effectively for the acquisition

and retention of top executive talent, we believe that we must have the flexibility to pay salary, bonus and other

compensation that may not be fully deductible under Section 162(m). Accordingly, the Compensation Committee

retains the authority to authorize payments that may not be deductible under Section 162(m) if it believes that such

payments are in the best interests of Pep Boys and our shareholders. All compensation paid to the named executive

officers in fiscal 2013 was fully deductible.