Pep Boys 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

NOTE 14—EQUITY COMPENSATION PLANS (Continued)

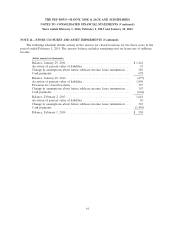

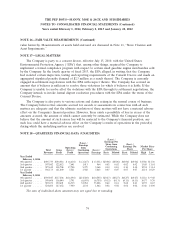

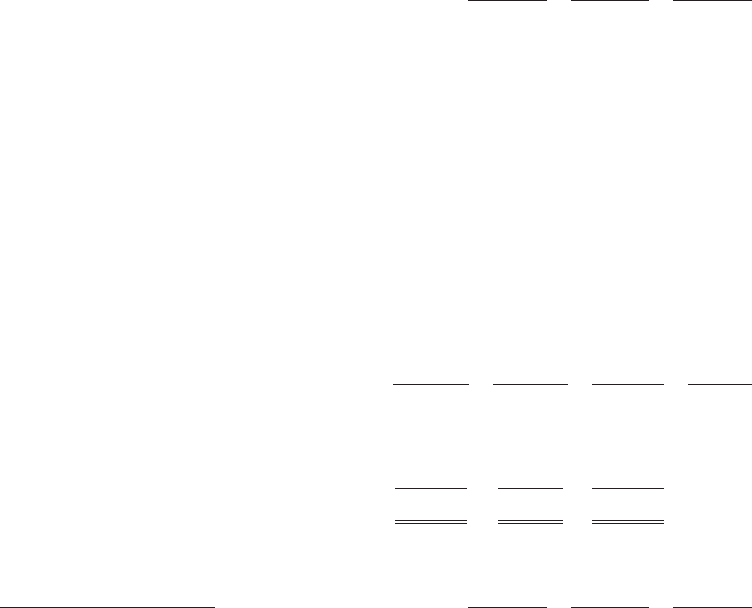

The following table summarizes information about options during the last three fiscal years (dollars

in thousands except per option):

Fiscal 2013 Fiscal 2012 Fiscal 2011

Weighted average fair value at grant date per

option .............................. $ 5.11 $4.65 $5.38

Intrinsic value of options exercised ........... $1,059 $ 874 $ 202

The aggregate intrinsic value of outstanding options, exercisable options and expected to vest

options at February 1, 2014 was $5.8 million, $5.5 million and $0.3 million, respectively. At February 1,

2014, the weighted average remaining contractual term of outstanding options, exercisable options and

expected to vest options was 4.1 years, 3.0 years and 6.6 years, respectively. At February 1, 2014, there

was approximately $1.7 million of total unrecognized pre-tax compensation cost related to non-vested

stock options, which is expected to be recognized over a weighted average period of 1.3 years.

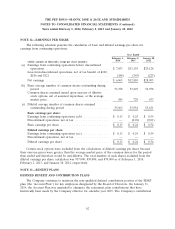

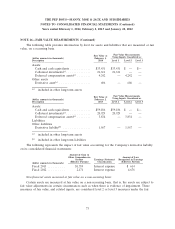

The following table summarizes information about non-vested PSUs and RSUs since February 2,

2013:

Weighted

Average

Number of Number of Fair

PSUs RSUs Total Value

Nonvested at February 2, 2013 ........ 651,305 145,295 796,600 $ 9.67

Granted ......................... 259,986 77,607 337,593 12.23

Forfeited ........................ (235,778) (7,442) (243,220) 9.30

Vested .......................... — (65,515) (65,515) 11.57

Nonvested at February 1, 2014 ........ 675,513 149,945 825,458 10.68

The following table summarizes information about RSUs during the last three fiscal years:

(dollar amounts in thousands) Fiscal 2013 Fiscal 2012 Fiscal 2011

Weighted average fair value at grant date per unit $12.23 $9.48 $10.45

Fair value at vesting date .................. $ 758 $768 $1,498

Intrinsic value at conversion date ............. $ 525 $218 $ 896

Tax benefits realized from conversions ......... $ 197 $ 82 $ 336

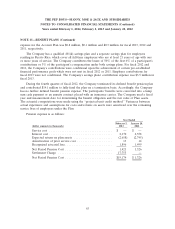

At February 1, 2014, there was approximately $2.7 million of total unrecognized pre-tax

compensation cost related to non-vested PSUs and RSUs in the aggregate, which is expected to be

recognized over a weighted-average period of 1.1 years.

The Company recognized approximately $1.2 million, $1.1 million, and $1.3 million of

compensation expense related to stock options, and approximately $1.8 million, $0.2 million, and

$1.9 million of compensation expense related to PSUs and RSUs in the aggregate, included in selling,

general and administrative expenses for fiscal 2013, 2012, and 2011, respectively. The related tax benefit

recognized was approximately $1.1 million, $0.4 million and $1.2 million for fiscal 2013, 2012 and 2011,

respectively.

69