Pep Boys 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

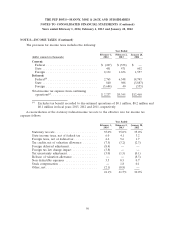

NOTE 5—DEBT AND FINANCING ARRANGEMENTS (Continued)

modification of the debt was treated as a debt extinguishment. The Company recorded $6.5 million of

deferred financing costs related to the Second Amended and Restated Credit Agreement.

Net proceeds from the fiscal 2012 amendment and restatement of the Term Loan together with

cash on hand were used to settle the Company’s outstanding interest rate swap on the Term Loan as

structured prior to its amendment and restatement and to satisfy and discharge all of the Company’s

outstanding 7.5% Senior Subordinated Notes (‘‘Notes’’) due 2014. The settlement of the interest rate

swap resulted in the reclassification of $7.5 million of accumulated other comprehensive loss to interest

expense. The Company recognized, in interest expense, $1.9 million of deferred financing costs related

to the Notes and the Term Loan as structured prior to its amendment and restatement. The interest

payment and the swap settlement payment are presented within cash flows from operations on the

consolidated statement of cash flows.

On October 11, 2012, the Company entered into two new interest rate swaps for a notional

amount of $50.0 million each that together were designated as a cash flow hedge on the first

$100.0 million of the Term Loan. The interest rate swaps convert the variable LIBOR portion of the

interest payments due on the first $100.0 million of the Term Loan to a fixed rate of 1.855%.

On November 12, 2013, the Company entered into the First Amendment to the Second Amended

and Restated Credit Agreement. The First Amendment reduced the interest rate payable by the

Company from (i) LIBOR, subject to a 1.25% floor, plus 3.75% to (ii) LIBOR, subject to a 1.25%

floor, plus 3.00%. The Company recorded $0.8 million of deferred financing costs related to the First

Amendment.

As of February 1, 2014, 142 stores collateralized the Term Loan. The amount outstanding under

the Term Loan as of February 1, 2014 and February 2, 2013 was $198.0 million and $200.0 million,

respectively.

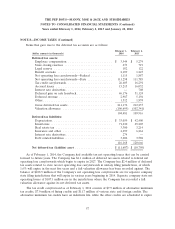

Revolving Credit Agreement Through July 2016

The Company has a Revolving Credit Agreement among the Company, Bank of America, N.A., as

Administrative Agent, and the other parties thereto providing for borrowings of up to $300.0 million

and having a maturity of July 2016. The interest rate on this facility is LIBOR plus a margin of 2.00%

to 2.50% for LIBOR rate borrowings or Prime plus 1.00% to 1.50% for Prime rate borrowings. The

margin is based upon the then current availability under the facility. As of February 1, 2014, the

Company had $3.5 million outstanding under the facility and $44.8 million of availability was utilized to

support outstanding letters of credit. Taking into account the borrowing base requirements (including

reduction for amounts outstanding under the supplier financing program), as of February 1, 2014 there

was $161.4 million of availability remaining under the facility.

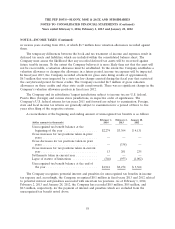

Other Matters

The Company’s debt agreements require compliance with covenants. The most restrictive of these

covenants, an earnings before interest, taxes, depreciation and amortization (‘‘EBITDA’’) requirement,

is triggered if the Company’s availability under its Revolving Credit Agreement plus unrestricted cash

drops below $50.0 million. As of February 1, 2014, the Company was in compliance with all financial

52