Pep Boys 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

4

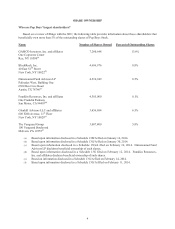

SHARE OWNERSHIP

Who are Pep Boys’ largest shareholders?

Based on a review of filings with the SEC, the following table provides information about those shareholders that

beneficially own more than 5% of the outstanding shares of Pep Boys Stock.

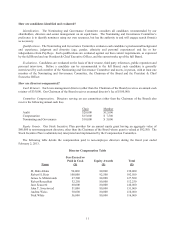

Name Number of Shares Owned Percent of Outstanding Shares

GAMCO Investors, Inc. and affiliates

One Corporate Center

Rye, NY 10580(a)

7,260,648 13.6%

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022(b)

4,686,976 8.8%

Dimensional Fund Advisors LP

Palisades West, Building One

6300 Bee Cave Road

Austin, TX 78746(c)

4,510,949 8.5%

Franklin Resources, Inc. and affiliates

One Franklin Parkway

San Mateo, CA 94403(d)

4,305,000 8.1%

Glenhill Advisors LLC and affiliates

600 Fifth Avenue, 11th Floor

New York, NY 10020(e)

3,456,684 6.5%

The Vanguard Group

100 Vanguard Boulevard

Malvern, PA 19355(f)

3,087,800 5.8%

(a) Based upon information disclosed in a Schedule 13D/A filed on January 16, 2014.

(b) Based upon information disclosed in a Schedule 13G/A filed on January 30, 2014.

(c) Based upon information disclosed in a Schedule 13G/A filed on February 10, 2014. Dimensional Fund

Advisers LP disclaims beneficial ownership of such shares.

(d) Based upon information disclosed in a Schedule 13G filed on February 12, 2014. Franklin Resources,

Inc. and affiliates disclaim beneficial ownership of such shares.

(e) Based on information disclosed in a Schedule 13G/A filed on February 14, 2014.

(f) Based upon information disclosed in a Schedule 13G/A filled on February 11, 2014.