Pep Boys 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

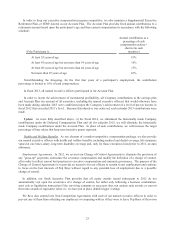

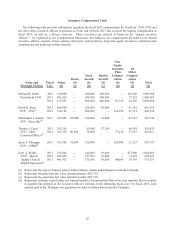

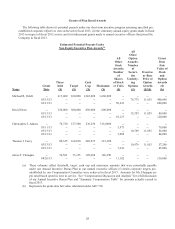

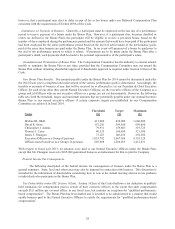

Grants of Plan Based Awards

The following table shows (i) potential payouts under our short-term incentive program assuming specified pre-

established corporate objectives were achieved in fiscal 2013, (ii) the customary annual equity grants made in fiscal

2013 in respect of fiscal 2012 service and (iii) inducement grants made to named executive officers that joined the

Company in fiscal 2013.

Estimated Potential Payouts Under

Non-Equity Incentive Plan Awards(a)

Name

Grant

Date

Thres-

hold

($)

Target

($)

Cash

Cap

($)

Maximum

($)

All

Other

Stock

Awards:

Number

of

Shares

of Stock

or Units

(#)

All

Other

Option

Awards:

Number

of

Securi-

ties

Underly-

ing

Options

(#)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant

Date

Fair

Value of

Stock

and

Option

Awards

($)

(b)

Michael R. Odell -- 415,000 830,000 1,245,000 1,660,000 -- -- -- --

03/13/13 -- -- -- -- -- 76,775 11.855 400,000

03/13/13 -- -- -- -- 50,633 -- -- 600,000

David Stern -- 150,000 300,000 450,000 600,000 -- -- -- --

03/13/13 -- -- -- -- -- 15,355 11.855 80,000

03/13/13 -- -- -- -- 10,127 -- -- 120,000

Christopher J. Adams -- 78,750 157,500 236,250 315,0000 -- -- -- --

03/11/13 -- -- -- -- 5,973 -- -- 70,000

03/13/13 -- -- -- -- -- 10,749 11.855 56,000

03/13/13 -- -- -- -- 7,089 -- -- 84,000

Thomas J. Carey -- 80,325 160,650 240,975 321,300 -- -- -- --

03/13/13 -- -- -- -- -- 10,979 11.855 57,200

03/13/13 -- -- -- -- 7,241 -- -- 85,800

James F. Flanagan -- 36,562 73,125 109,688 146,250 -- -- -- --

08/26/13 -- -- -- -- 11,102 -- -- 130,000

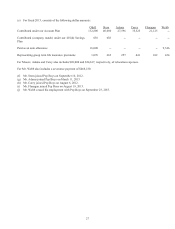

(a) These columns reflect threshold, target, cash cap and maximum amounts that were potentially payable

under our Annual Incentive Bonus Plan to our named executive officers if certain corporate targets pre-

established by our Compensation Committee were achieved in fiscal 2013. Amounts for Mr. Flanagan are

pro rated based upon his time in service. See “Compensation Discussion and Analysis” for a full discussion

of our Annual Incentive Bonus Plan and “Summary Compensation Table” for amounts actually earned in

fiscal 2013.

(b) Represents the grant-date fair value calculated under ASC 718.