Pep Boys 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(classified as trade payable program liability on the consolidated balance sheet). In the fourth quarter

of fiscal 2012, our Board of Directors authorized a program to repurchase up to $50.0 million of our

common stock. During fiscal 2013, we had common stock repurchases of $2.8 million plus principal

payments of $2.0 million on our amended and restated Senior Secured Term Loan (‘‘Term Loan’’), that

were offset by increased borrowings of $3.5 million on our revolving credit facility.

During fiscal 2012, we had common stock repurchases of $0.3 million. In addition, during the third

quarter of 2012, we increased the amount of our borrowing under our Term Loan from $150.0 million

to $200.0 million and used those proceeds together with cash on hand to repay, in full, the

$147.0 million principal amount then outstanding under our 7.5% Senior Subordinated Notes due 2014

and to settle our outstanding interest rate swap (see Note 5 to the Consolidated Financial Statements).

As a result of the refinancing, we reduced our total debt by $95.1 million and extended its maturity to

2018. The Company recorded $6.5 million of deferred financing costs related to this refinancing. In the

fourth quarter of fiscal 2013, the Company further amended the Term loan by reducing the interest

rate by 75 basis points. The Company recorded $0.8 million of deferred financing costs related to this

amendment. The reduction in the interest rate is anticipated to result in approximately $1.5 million in

annualized interest savings.

We anticipate that cash on hand and cash generated by operating activities will exceed our

expected cash requirements in fiscal 2014. In addition, we expect to have excess availability under our

existing revolving credit agreement during the entirety of fiscal 2014. As of February 1, 2014, we had

availability on our revolving credit facility of $161.4 million. As of February 1, 2014 we had

$33.4 million of cash and cash equivalents on hand.

Our working capital was $131.0 million and $126.5 million at February 1, 2014 and February 2,

2013, respectively. Our total debt, net of cash on hand, as a percentage of our net capitalization, was

23.5% and 20.8% at February 1, 2014 and February 2, 2013, respectively.

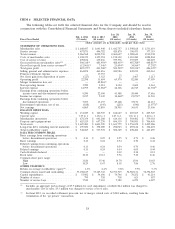

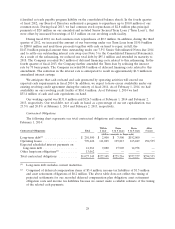

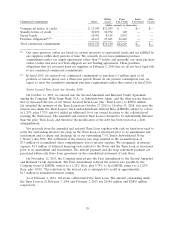

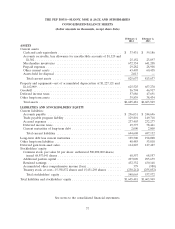

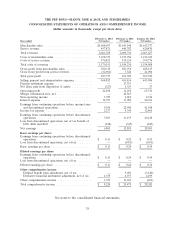

Contractual Obligations

The following chart represents our total contractual obligations and commercial commitments as of

February 1, 2014:

Within From From After

Contractual Obligations Total 1 year 1 to 3 years 3 to 5 years 5 years

(dollars amounts in thousands)

Long-term debt(1) ................... $ 201,500 $ 2,000 $ 7,500 $192,000 —

Operating leases .................... 770,622 111,025 199,813 165,249 294,535

Expected scheduled interest payments on

long-term debt .................... 41,961 9,080 17,903 14,978 —

Other long-term obligations(2) .......... 13,062 — — — —

Total contractual obligations ........... $1,027,145 $122,105 $225,216 $372,227 $294,535

(1) Long-term debt includes current maturities.

(2) Comprised of deferred compensation items of $5.4 million, income tax liabilities of $1.5 million

and asset retirement obligations of $6.2 million. The above table does not reflect the timing of

projected settlements for our recorded deferred compensation plan obligation, asset retirement

obligation costs and income tax liabilities because we cannot make a reliable estimate of the timing

of the related cash payments.

28