Pep Boys 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

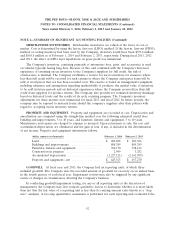

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

RECENT ACCOUNTING STANDARDS

In July 2013, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards

Update (‘‘ASU’’) No. 2013-11, ‘‘Presentation of an Unrecognized Tax Benefit When a Net Operating

Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists’’ (‘‘ASU 2013-11’’).

ASU 2013-11 states that an unrecognized tax benefit should be presented in the financial statements as

a reduction to a deferred tax asset for a net operating loss carryforward or a tax credit carryforward, if

available at the reporting date under the applicable tax law to settle any additional income taxes that

would result from the disallowance of a tax position. If the tax law of the applicable jurisdiction does

not require the entity to use, and the entity does not intend to use, the deferred tax asset for such

purpose, the unrecognized tax benefit should be presented in the financial statements as a liability. The

amendments in this ASU are effective for fiscal years, and interim periods within those years, beginning

after December 15, 2013. The adoption of ASU 2013-11 did not have a material impact on the

Company’s consolidated financial statements.

In February 2013, the FASB issued ASU No. 2013-02, ‘‘Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income’’ (‘‘ASU 2013-02’’), which requires companies to provide

information about the amounts reclassified out of accumulated other comprehensive income (‘‘AOCI’’)

by component. In addition, companies are required to report significant amounts reclassified out of

AOCI by the respective line items of net income if the amount reclassified is required to be reclassified

to net income in its entirety in the same reporting period. For amounts that are not required to be

reclassified in their entirety to net income, companies are required to cross-reference to other

disclosures that provide additional detail on those amounts. ASU 2013-02 does not change the current

requirements for reporting net income or other comprehensive income in the financial statements, and

is effective prospectively for reporting periods beginning after December 15, 2012. The adoption of

ASU 2013-02 did not have a material impact on the Company’s consolidated financial statements.

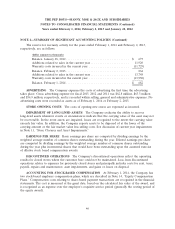

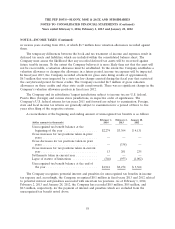

NOTE 2—ACQUISITIONS

During the third quarter of 2013, the Company paid $10.7 million to purchase 18 Service & Tire

Centers located in Southern California from AKH Company, Inc., which had operated under the name

Discount Tire Centers. This acquisition was financed using cash on hand. Collectively, the acquired

stores produced approximately $26.1 million in sales annually based on unaudited pre-acquisition

historical information. Revenues attributable to the acquired stores are currently immaterial to date.

The results of operations of these acquired stores are included in the Company’s results of operations

as of the date of acquisition.

The Company expensed all costs related to this acquisition during Fiscal 2013. The total costs

related to this acquisition were immaterial and are included in the consolidated statement of operations

within selling, general and administrative expenses.

48