Pep Boys 2013 Annual Report Download - page 104

Download and view the complete annual report

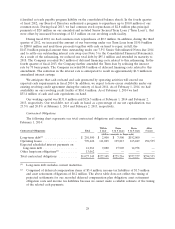

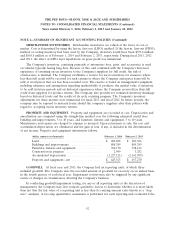

Please find page 104 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.minimal. We establish a reserve for excess inventory for instances where less than full credit will

be received for such returns and where we anticipate items will be sold at retail prices that are

less than recorded costs. The reserve is based on management’s judgment, including estimates

and assumptions regarding marketability of products, the market value of inventory to be sold in

future periods and on historical experiences where we received less than full credit from

suppliers for product returns. If our estimates regarding excess inventory are inaccurate, we may

incur losses or gains that could be material. A 10% difference in our inventory reserves as of

February 1, 2014 would have affected net earnings by approximately $0.3 million in fiscal 2013.

• We record reserves for future sales returns, customer incentives, warranty claims and inventory

shrinkage. The reserves are based on expected returns of products and historical claims and

inventory shrinkage experience. If actual experience differs from historical levels, revisions in our

estimates may be required. A 10% change in these reserves at February 1, 2014 would have

affected net earnings by approximately $0.8 million for fiscal 2013.

• We have risk participation arrangements with respect to workers’ compensation, general liability,

automobile liability, other casualty coverage and health care insurance, including stop loss

coverage with third party insurers to limit our total exposure. A reserve for the liabilities

associated with these agreements is established using generally accepted actuarial methods

followed in the insurance industry and our historical claims experience. The amounts included in

our costs related to these arrangements are estimated and can vary based on changes in

assumptions, claims experience or the providers included in the associated insurance programs.

A 10% change in our self-insurance liabilities at February 1, 2014 would have affected net

earnings by approximately $5.7 million for fiscal 2013.

• At fiscal year end 2013, we had six reporting units, of which three included goodwill. We test the

recorded amount of goodwill for recovery on an annual basis in the fourth quarter of each fiscal

year. Impairment reviews may also be triggered by any significant events or changes in

circumstances affecting our business.

In conducting goodwill impairment testing, for any or all reporting units at the discretion of

management, we may first evaluate qualitative factors to determine whether it is more likely

than not that the fair value of a reporting unit is less than its carrying amount (also known as a

‘‘step zero’’ analysis). A two-step quantitative assessment is performed for each reporting unit

evaluated if the qualitative assessment indicates that the carrying value more likely than not

exceeds the fair value of the reporting unit, or if a qualitative assessment is not performed.

The first step of the quantitative evaluation is to compare the fair value of a reporting unit with

its carrying amount. If the carrying amount of a reporting unit exceeds its fair value, the second

step of the impairment test must be performed in order to determine the amount of impairment

loss, if any. The second step compares the implied fair value of reporting unit goodwill with the

carrying amount of that goodwill. If the carrying amount of reporting unit goodwill exceeds the

implied fair value of that goodwill, an impairment loss is recognized in an amount equal to the

excess. The loss recognized cannot exceed the carrying amount of goodwill. The implied fair

value of goodwill is determined in the same manner that the amount of goodwill recognized in a

business combination is determined. We allocate the fair value of a reporting unit to all of the

assets and liabilities of that unit, including intangible assets. Any excess of the value of a

reporting unit over the amounts assigned to its assets and liabilities is the implied fair value of

goodwill. A deterioration of macroeconomic conditions may not only negatively impact the

estimated operating cash flows used in our cash flow models, but may also negatively impact

other assumptions used in our analyses, including, but not limited to, the estimated cost of

capital and/or discount rates. Additionally, in accordance with accounting guidance, we are

required to ensure that assumptions used to determine fair value in the analyses are consistent

32