Pep Boys 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

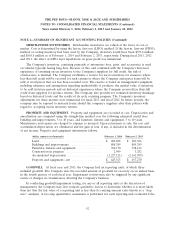

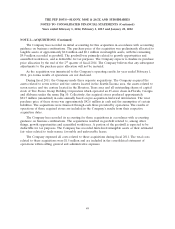

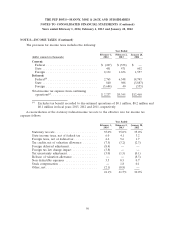

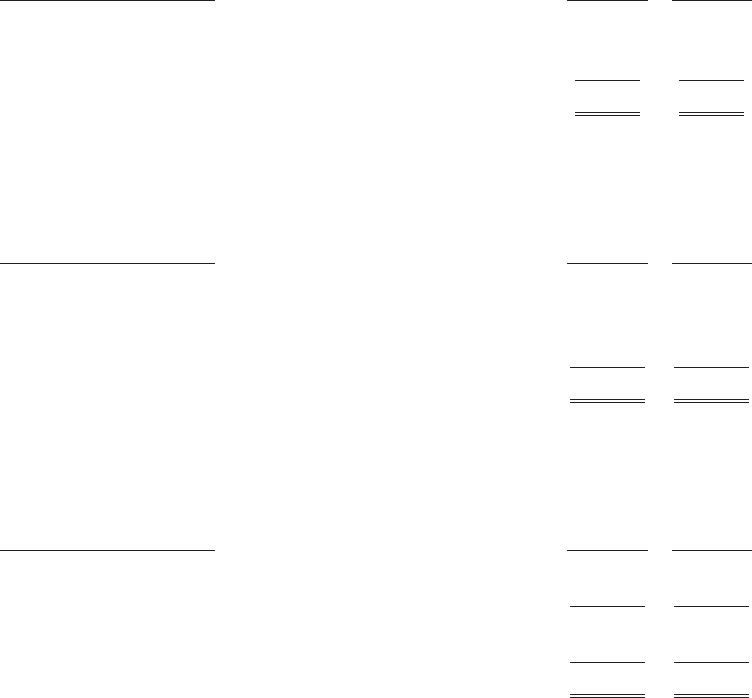

NOTE 3—OTHER CURRENT ASSETS

The following are the components of other current assets:

February 1, February 2,

(dollar amounts in thousands) 2014 2013

Reinsurance receivable ............................ $61,182 $59,160

Income taxes receivable ............................ 1,643 668

Other ......................................... 580 610

Total ......................................... $63,405 $60,438

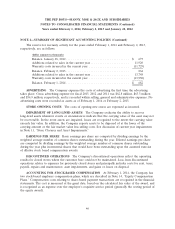

NOTE 4—ACCRUED EXPENSES

The following are the components of accrued expenses:

February 1, February 2,

(dollar amounts in thousands) 2014 2013

Casualty and medical risk insurance ................... $153,830 $152,606

Accrued compensation and related taxes ................ 30,645 27,641

Sales tax payable ................................. 12,245 11,556

Other ......................................... 40,683 40,474

Total ......................................... $237,403 $232,277

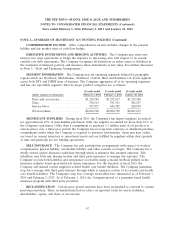

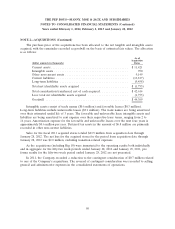

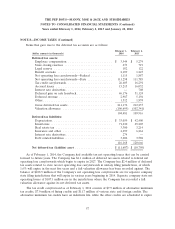

NOTE 5—DEBT AND FINANCING ARRANGEMENTS

The following are the components of debt and financing arrangements:

February 1, February 2,

(dollar amounts in thousands) 2014 2013

Senior Secured Term Loan, due October 2018 ........... $198,000 $200,000

Revolving Credit Agreement, through July 2016 .......... 3,500 —

Long-term debt ................................ 201,500 200,000

Current maturities ................................ (2,000) (2,000)

Long-term debt less current maturities ............... $199,500 $198,000

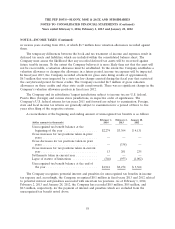

Senior Secured Term Loan due October 2018

On October 11, 2012, the Company entered into the Second Amended and Restated Credit

Agreement among the Company, Wells Fargo Bank, N.A., as Administrative Agent, and the other

parties thereto that (i) increased the size of the Company’s Senior Secured Term Loan (the ‘‘Term

Loan’’) to $200.0 million, (ii) extended the maturity of the Term Loan from October 27, 2013 to

October 11, 2018, (iii) reset the interest rate under the Term Loan to the London Interbank Offered

Rate (LIBOR), subject to a floor of 1.25%, plus 3.75% and (iv) added an additional 16 of the

Company’s owned locations to the collateral pool securing the Term Loan. The amended and restated

Term Loan was deemed to be substantially different than the prior Term Loan, and therefore the

51