Pep Boys 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss of critical data and interruptions or delays in our ability to process transactions and manage

inventory. Any such loss, if widespread or extended, could adversely affect the operation of our

business and our results of operations.

Risks Related to Our Industry

Our industry is highly competitive, and price competition in some segments of the automotive

aftermarket, or a loss of trust in our participation in the ‘‘do-it-for-me’’ market, could cause a material

decline in our revenues and earnings.

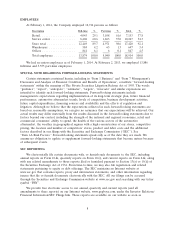

The automotive aftermarket retail and service industry is highly competitive and subjects us to a

wide variety of competitors. We compete primarily with the following types of businesses in each

segment of the automotive aftermarket:

Retail

Do-It-Yourself

• automotive parts and accessories stores;

• automobile dealers that supply manufacturer replacement parts and accessories;

• mass merchandisers and wholesale clubs that sell automotive products and select non-automotive

merchandise that appeals to automotive ‘‘Do-It-Yourself’’ customers, such as generators, power

tools and canopies; and

• online retailers

Commercial

• mass merchandisers, wholesalers and jobbers (some of which are associated with national parts

distributors or associations).

Service

Do-It-For-Me

• regional and local full service automotive repair shops;

• automobile dealers that provide repair and maintenance services;

• national and regional (including franchised) tire retailers that provide additional automotive

repair and maintenance services; and

• national and regional (including franchised) specialized automotive (such as oil change, brake

and transmission) repair facilities that provide additional automotive repair and maintenance

services.

Tires

• national and regional (including franchised) tire retailers; and

• mass merchandisers and wholesale clubs that sell tires.

A number of our competitors have more financial resources, are more geographically diverse, have

a higher geographic market concentration or have better name recognition than we do, which might

place us at a competitive disadvantage to those competitors. Because we seek to offer competitive

prices, if our competitors reduce their prices we may also be forced to reduce our prices, which could

cause a material decline in our revenues and earnings.

13