Pep Boys 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

Committee does not have the power to amend or modify any provision of the Bonus Plan without shareholder

approval in a manner that would affect the terms of the Bonus Plan applicable to any bonus intended to constitute

qualified performance-based compensation under Section 162(m) of the Code, if shareholder approval is required

under Section 162(m) of the Code. As administrator of the Bonus Plan, the Compensation Committee’s authority

includes, without limitation, the right to select participants, to determine each participant’s minimum, maximum and

target bonus amounts (each expressed as a percentage of the participant’s base salary), to determine the time or times

of paying bonuses, to establish and approve corporate and individual performance goals and the relative weightings

of the goals, to approve bonuses under the Bonus Plan, to change the performance period for bonuses, to decide the

facts in any case arising under the Bonus Plan and to make all other determinations, including factual determinations,

and to take all other actions necessary or appropriate for the proper administration of the Bonus Plan. All actions

taken, and all determinations made, by the Compensation Committee are final, binding and conclusive on all parties,

including us and Bonus Plan participants.

Eligibility and Participation. Our officer and director level employees are eligible to participate in the Bonus

Plan for each fiscal year, or portion thereof in which the employee holds such position, unless excluded from

participation by the Compensation Committee. Members of our Board of Directors who are not our employees are

not eligible to participate in the Bonus Plan.

As soon as practicable, but no later than ninety days after the beginning of the performance period, the

Compensation Committee will determine the employees who will be participants for the performance period.

Subject to certain limited exceptions described below, an employee must be actively employed on the last day of the

performance period in order to be eligible to receive a bonus for that period. Unless the Compensation Committee

determines otherwise, employees who become eligible to participate in the Bonus Plan after the performance period

has begun will receive a prorated bonus for the performance period in which they first become eligible. Participants

in the Bonus Plan will also be eligible to participate in such other bonus, sales incentive plan or other compensation

programs as we may establish. Each participant in the Bonus Plan will earn bonuses at one of a pre-determined

number of bonus. If a participant is employed at more than one bonus level during a performance period, the total

bonus amount for which such participant will be eligible to receive will be prorated based on the period of time

during the performance period that such individual was employed at each bonus level. All of our 22 officers and 248

additional employees are eligible and have been selected to participate in the Bonus Plan.

Performance Period. Unless the Compensation Committee determines otherwise, the performance period for

which the performance goals will be measured will be our fiscal year.

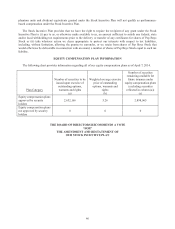

Establishment of Plan Components. Within the first ninety days of each performance period, the Compensation

Committee will determine (i) the participants; (ii) the minimum, target and maximum performance levels for each of

the objective business criteria being used; (iii) the relative weightings of the respective objective business criteria

being used; (iv) the minimum, target, and maximum bonus amounts (each expressed as a percentage of base salary)

at each bonus level; and (v) the percentages of the bonus amounts (which percentages may be different for each

participant) that are attributable to the performance during the performance period; provided, however, that in the

case of any bonus designated as qualified performance-based compensation for purposes of Section 162(m) of the

Code, the Compensation Committee will make such determinations no later than ninety days after the beginning of

the performance period or the date on which 25% of the performance period has been completed, whichever is

earlier. To the extent a bonus is designated as qualified performance-based compensation under Section 162(m) of

the Code, no such bonus will be made as an alternative to any other award that is not designated as qualified

performance-based compensation and such bonus will be separate and apart from all other awards made.

For purposes of the Bonus Plan, base salary means the participant’s base salary for the fiscal year, which includes

amounts the participant elects to forego to our Deferred Compensation Plan (other than equity-based deferred

compensation), and amounts the participant elects to forego under our 401(k) plan. Base salary does not include any

amount attributable to any bonuses paid or accrued, whether or not pursuant to a plan or program.

Section 162(m) of the Code requires us to establish a maximum annual bonus that can be paid to any individual

under the Bonus Plan. As a result, the Bonus Plan provides that the maximum amount that can be paid for a bonus