Pep Boys 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

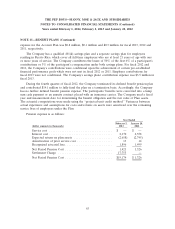

NOTE 13—BENEFIT PLANS (Continued)

Guaranteed annuity contracts (‘‘GACs’’) are annuity insurance contracts. GACs are primarily

invested in public bonds with some small placement in common stock, private placement bonds and

commercial mortgage products. The GACs are valued based on unobservable inputs, as observable

inputs are not available, using valuation methodologies to determine fair value. GACs are deemed to

be Level 3 investments.

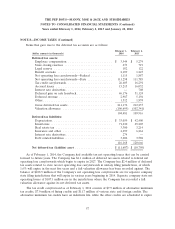

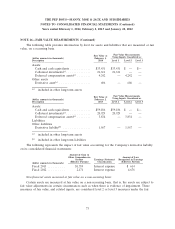

The following table provides a summary of changes in fair value of Level 3 financial assets during

fiscal 2012:

Fair

(dollar amounts in thousands) Value

Balance, January 28, 2012 .................................... $1,334

Transfers from other investments ............................... —

Interest income and gains .................................... 116

Administrative fees ......................................... (72)

Benefits paid during the period ................................ (1,378)

Balance, February 2, 2013 .................................... $ —

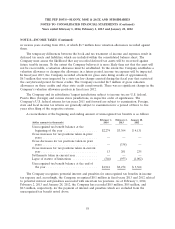

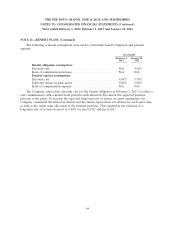

DEFERRED COMPENSATION PLAN

The Company maintains a non-qualified deferred compensation plan that allows its officers and

certain other employees to defer up to 20% of their annual salary and 100% of their annual bonus.

The first 20% of an officer’s bonus deferred into the Company’s stock was matched by the Company

on a one-for-one basis with Company stock that vests and is expensed over three years. The shares

required to satisfy distributions of voluntary bonus deferrals and the accompanying match in the

Company’s stock are issued from its treasury account. On January 31, 2014, the Company amended the

deferred compensation plan to eliminate the automatic matching employer contributions effective for

fiscal 2014.

RABBI TRUST

The Company establishes and maintains a deferred liability for the non-qualified deferred

compensation plan and the Account Plan. The Company plans to fund this liability by remitting the

officers’ deferrals to a Rabbi Trust where these are invested in variable life insurance policies. These

assets are included in non-current other assets and are considered to be a Level 2 measure within the

fair value hierarchy. Accordingly, all gains and losses on these underlying investments, which are held

in the Rabbi Trust to fund the deferred liability, are recognized in the Company’s Consolidated

Statement of Operations. Under these plans, there were liabilities of $6.9 million at February 1, 2014

and $6.7 million at February 2, 2013, respectively, which are recorded primarily in other long-term

liabilities.

67