Pep Boys 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

however, that a participant may elect to defer receipt of his or her bonus under our Deferred Compensation Plan

consistent with the requirements of Section 409A of the Code.

Limitations on Payment of Bonuses. Generally, a participant must be employed on the last day of a performance

period to receive payment of a bonus under the Bonus Plan. However, if a participant dies, becomes disabled or

retires (as defined in the Bonus Plan), the participant will be eligible to receive a pro-rated bonus, based on the

number of days employed during the performance period and the amount that would have been paid if the participant

had been employed for the entire performance period based on the level of achievement of the performance goals,

paid at the same time bonuses are paid under the Bonus Plan. In no event will payment of a bonus be paid prior to

the end of the performance period to which it relates. If payments are to be made under the Bonus Plan after a

participant’s death, such payments shall be made to the personal representative of the participant’s estate.

Amendment and Termination of Bonus Plan. The Compensation Committee has the authority to extend, amend,

modify or terminate the Bonus Plan at any time; provided that the Compensation Committee may not amend the

Bonus Plan without obtaining shareholder approval if shareholder approval is required under Section 162(m) of the

Code.

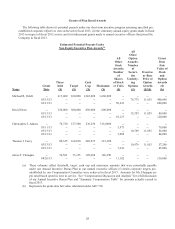

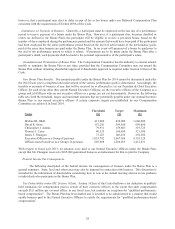

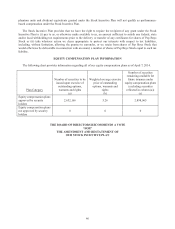

New Bonus Plan Benefits. The amounts payable under the Bonus Plan for 2014 cannot be determined until after

the 2014 fiscal year is completed and achievement of the various performance goals is determined. Accordingly, the

benefits or amounts of bonuses, if any, that will be received by or allocated to: (a) our President & Chief Executive

Officer; (b) each of our other then current Named Executive Officers; (c) the executive officers of the Company as a

group; and (d) Officers who are not executive officers as a group, are not yet determinable. However, the following

table sets forth the threshold, target, and maximum amounts that are potentially payable under our Annual Incentive

Bonus Plan to our named executive officers if certain corporate targets pre-established by our Compensation

Committee are achieved in fiscal 2014.

Name

Threshold

($)

Target

($)

Maximum

($)

Michael R. Odell 415,000 830,000 1,660,000

David R. Stern 152,250 304,500 609,000

Christopher J. Adams 79,931 159,863 319,725

Thomas J. Carey 80,325 160,650 321,300

James F. Flanagan 73,125 146,250 292,500

Executive Officers as a Group (8 persons) 1,033,782 2,067,564 4,135,128

Officers (non-Executive) as a Group (14 persons) 603,008 1,206,015 2,412,031

With respect to fiscal year 2013, no amounts were paid to our Named Executive Officers under the Bonus Plan,

except that Mr. Flanagan received a $105,000 guaranteed bonus as an inducement for him to join the Company.

Federal Income Tax Consequences.

The following description of the federal income tax consequences of bonuses under the Bonus Plan is a

general summary. State, local and other taxes may also be imposed in connection with bonuses. This discussion is

intended for the information of shareholders considering how to vote at the annual meeting and not as tax guidance

to individuals who participate in the Bonus Plan.

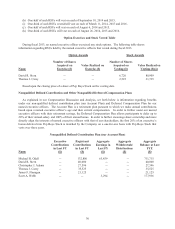

Tax Deductibility under IRC Section 162(m). Section 162(m) of the Code disallows a tax deduction to publicly

held companies for compensation paid to certain of their executive officers to the extent that such compensation

exceeds $1.0 million per covered officer in any fiscal year, but contains an exception for “qualified performance-

based compensation”. The Bonus Plan has been drafted and is intended to be administered in a manner that would

enable bonuses paid to the Named Executive Officers to satisfy the requirements for “qualified performance-based

compensation”.