Pep Boys 2013 Annual Report Download - page 106

Download and view the complete annual report

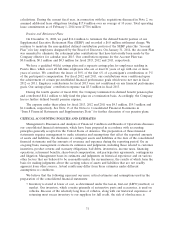

Please find page 106 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impacted. While it is often difficult to predict the final outcome of, the timing of, or the tax

treatment of any particular tax position or deduction, we believe that our tax balances reflect the

more-likely-than-not outcome of known tax contingencies.

The temporary differences between the book and tax treatment of income and expenses result in

deferred tax assets and liabilities, which are included within our consolidated balance sheets. We

must then assess the likelihood that our deferred tax assets will be recovered from future taxable

income. To the extent we believe that recovery is not more-likely-than-not, we must establish a

valuation allowance. To the extent we establish a valuation allowance or change the allowance in

a future period, income tax expense will be impacted. Actual results could differ from this

assessment if adequate taxable income is not generated in future periods from either operations

or projected tax planning strategies.

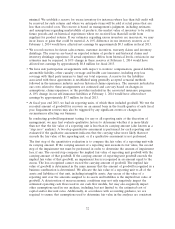

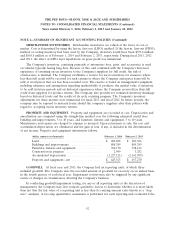

RECENT ACCOUNTING STANDARDS

In July 2013, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards

Update (‘‘ASU’’) No. 2013-11, ‘‘Presentation of an Unrecognized Tax Benefit When a Net Operating

Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists’’ (‘‘ASU 2013-11’’).

ASU 2013-11 states that an unrecognized tax benefit should be presented in the financial statements as

a reduction to a deferred tax asset for a net operating loss carryforward or a tax credit carryforward, if

available at the reporting date under the applicable tax law to settle any additional income taxes that

would result from the disallowance of a tax position. If the tax law of the applicable jurisdiction does

not require the entity to use, and the entity does not intend to use, the deferred tax asset for such

purpose, the unrecognized tax benefit should be presented in the financial statements as a liability. The

amendments in this ASU are effective for fiscal years, and interim periods within those years, beginning

after December 15, 2013. The adoption of ASU 2013-11 did not have a material impact on the

Company’s consolidated financial statements.

In February 2013, the FASB issued ASU No. 2013-02, ‘‘Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income’’ (‘‘ASU 2013-02’’), which requires companies to provide

information about the amounts reclassified out of accumulated other comprehensive income (‘‘AOCI’’)

by component. In addition, companies are required to report significant amounts reclassified out of

AOCI by the respective line items of net income if the amount reclassified is required to be reclassified

to net income in its entirety in the same reporting period. For amounts that are not required to be

reclassified in their entirety to net income, companies are required to cross-reference to other

disclosures that provide additional detail on those amounts. ASU 2013-02 does not change the current

requirements for reporting net income or other comprehensive income in the financial statements, and

is effective prospectively for reporting periods beginning after December 15, 2012. The adoption of

ASU 2013-02 did not have a material impact on the Company’s consolidated financial statements.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have market rate exposure in our financial instruments due to changes in interest rates and

prices.

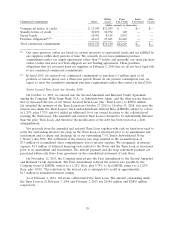

Variable and Fixed Rate Debt

Our primary market risk exposure with regard to financial instruments is due to changes in interest

rates. Pursuant to the terms of our Revolving Credit Agreement, changes in daily LIBOR could affect

the rates at which we could borrow funds thereunder. At February 1, 2014, there was $3.5 million in

outstanding borrowings under the agreement. Additionally, we have a $200.0 million Term Loan that

was amended on November 12, 2013 to reduce the interest rate payable by the Company from LIBOR,

subject to a 1.25% floor, plus 3.75% to LIBOR, subject to a 1.25% floor, plus 3.00%. Excluding our

34