Pep Boys 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended February 1, 2014, February 2, 2013 and January 28, 2012

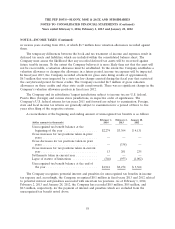

NOTE 2—ACQUISITIONS (Continued)

The Company has recorded its initial accounting for this acquisition in accordance with accounting

guidance on business combinations. The purchase price of the acquisition was preliminarily allocated to

tangible assets of approximately $0.8 million and $0.1 million in intangible assets, with the remaining

$9.9 million recorded as goodwill. The goodwill was primarily related to growth opportunities and

assembled workforces, and is deductible for tax purposes. The Company expects to finalize its purchase

price allocation by the end of the 2nd quarter of fiscal 2014. The Company believes that any subsequent

adjustments to the purchase price allocation will not be material.

As the acquisition was immaterial to the Company’s operating results for year ended February 1,

2014, pro forma results of operations are not disclosed.

During fiscal 2011, the Company made three separate acquisitions. The Company acquired the

assets related to seven service and tire centers located in the Seattle-Tacoma area, the assets related to

seven service and tire centers located in the Houston, Texas area and all outstanding shares of capital

stock of Tire Stores Group Holding Corporation which operated an 85-store chain in Florida, Georgia

and Alabama under the name Big 10. Collectively, the acquired stores produced approximately

$94.7 million (unaudited) in sales annually based on pre-acquisition historical information. The total

purchase price of these stores was approximately $42.6 million in cash and the assumption of certain

liabilities. The acquisitions were financed through cash flows provided by operations. The results of

operations of these acquired stores are included in the Company’s results from their respective

acquisition dates.

The Company has recorded its accounting for these acquisitions in accordance with accounting

guidance on business combinations. The acquisitions resulted in goodwill related to, among other

things, growth opportunities and assembled workforces. A portion of the goodwill is expected to be

deductible for tax purposes. The Company has recorded finite-lived intangible assets at their estimated

fair value related to trade names, favorable and unfavorable leases.

The Company expensed all costs related to these acquisitions during fiscal 2011. The total costs

related to these acquisitions were $1.5 million and are included in the consolidated statement of

operations within selling, general and administrative expenses.

49