Pep Boys 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

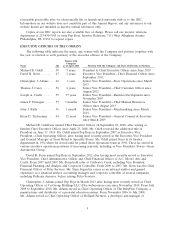

ITEM 2 PROPERTIES

The Company owns its five-story, approximately 300,000 square foot corporate headquarters in

Philadelphia, Pennsylvania. The Company also owns the following administrative regional offices—

approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico.

The Company leases an administrative regional office of approximately 3,500 square feet in Los

Angeles, California.

Of the 799 store locations operated by the Company at February 1, 2014, 228 are owned and 571

are leased. As of February 1, 2014, 142 of the 228 stores owned by the Company are currently used as

collateral under our Senior Secured Term Loan, due October 2018.

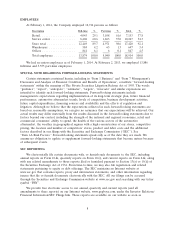

The following table sets forth certain information regarding the owned and leased warehouse space

utilized by the Company to replenish its store locations at February 1, 2014:

Approximate Owned

Products Square or Stores

Warehouse Locations Warehoused Footage Leased Serviced States Serviced

San Bernardino, CA . . . All 600,000 Leased 196 AZ, CA, NV, UT, WA

McDonough, GA ..... All 392,000 Owned 244 AL, FL, GA, LA, NC, PR, SC, TN

Mesquite, TX ........ All 244,000 Owned 82 AR, CO, LA, MO, NM, OK, TX

Plainfield, IN ........ All 403,000 Owned 80 IL, IN, KY, MI, MN, OH, PA

Chester, NY ......... All 402,000 Owned 197 CT, DE, MA, MD, ME, NH, NJ,

NY, PA, RI, VA

Philadelphia, PA ...... Tires & Batteries 74,000 Leased 70 DE, NJ, PA, VA, MD

Total .............. 2,115,000

The Company anticipates that its existing and future warehouse space and its access to outside

storage will accommodate inventory necessary to support future store expansion and any increase in

SKUs through the end of fiscal 2014.

ITEM 3 LEGAL PROCEEDINGS

The Company is party to a consent decree, effective July 15, 2010, with the United States

Environmental Protection Agency (‘‘EPA’’) that, among other things, required the Company to

implement a formal compliance program with respect to certain small gasoline engine merchandise sold

by the Company. In the fourth quarter of fiscal 2013, the EPA alleged, in writing, that the Company

had violated certain inspection, testing and reporting requirements of the Consent Decree and made an

aggregated stipulated penalty demand of $2.3 million as a result thereof. The Company is currently

engaged in settlement negotiations with the EPA with respect thereto. The Company has accrued an

amount that it believes is sufficient to resolve those violations for which it believes it is liable. If the

Company is unable to resolve all of the violations with the EPA through its settlement negotiations, the

Company intends to invoke formal dispute resolution procedures with the EPA under the terms of the

Consent Decree.

The Company is also party to various actions and claims arising in the normal course of business.

The Company believes that amounts accrued for awards or assessments in connection with all such

matters are adequate and that the ultimate resolution of these matters will not have a material adverse

effect on the Company’s financial position. However, there exists a possibility of loss in excess of the

amounts accrued, the amount of which cannot currently be estimated. While the Company does not

believe that the amount of such excess loss will be material to the Company’s financial position, any

such loss could have a material adverse effect on the Company’s results of operations in the period(s)

during which the underlying matters are resolved.

ITEM 4 MINE SAFETY DISCLOSURES

Not applicable.

15