Pep Boys 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interest rate swap, a one percent change in the LIBOR rate would have affected net earnings by

approximately $1.5 million for fiscal 2013. The risks related to changes in the LIBOR rate are

substantially mitigated by our interest rate swap.

The fair value of our long-term debt including current maturities was $203.7 million at February 1,

2014. We determine fair value on our fixed rate debt by using quoted market prices and current

interest rates.

Interest Rate Swaps

On October 11, 2012, we settled our interest rate swap designated as a cash flow hedge on

$145.0 million of our Term Loan prior to its amendment and restatement. The swap was used to

minimize interest rate exposure and overall interest costs by converting the variable component of the

total interest rate to a fixed rate of 5.036%. Since February 1, 2008, this swap was deemed to be fully

effective and all adjustments in the interest rate swap’s fair value have been recorded to accumulated

other comprehensive loss. The settlement of this swap resulted in an interest charge of $7.5 million,

which was previously recorded within accumulated other comprehensive loss.

On October 11, 2012, we entered into two new interest rate swaps for a notional amount of

$50.0 million each that together are designated as a cash flow hedge on the first $100.0 million of the

amended and restated Term Loan. The interest rate swaps convert the variable LIBOR portion of the

interest payments, subject to a floor of 1.25%, due on the first $100.0 million of the Term Loan to a

fixed rate of 1.855%.

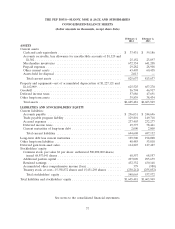

As of February 1, 2014 and February 2, 2013, the fair value of the new interest rate swaps was a

net $0.6 million asset and a $1.6 million payable, respectively. The swap value is recorded within other

long-term assets or other long-term liabilities on the balance sheet.

35