Pep Boys 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

entirety of fiscal 2010. As of January 30, 2010, we had undrawn availability under our Revolving Credit

Agreement of $137,848,000.

Our working capital was $205,525,000 and $179,233,000 at January 30, 2010 and January 31, 2009,

respectively. Our long-term debt, as a percentage of our total capitalization, was 41% and 45% at

January 30, 2010 and January 31, 2009, respectively.

As of January 30, 2010, we had an outstanding balance of $34,099,000 (classified as trade payable

program liability on the condensed consolidated balance sheet) under our vendor financing program.

The vendor financing program, which is funded by various bank participants who have the ability, but

not the obligation, to purchase account receivables owed by us directly from our vendors.

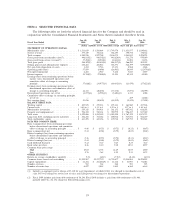

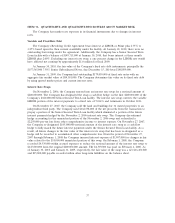

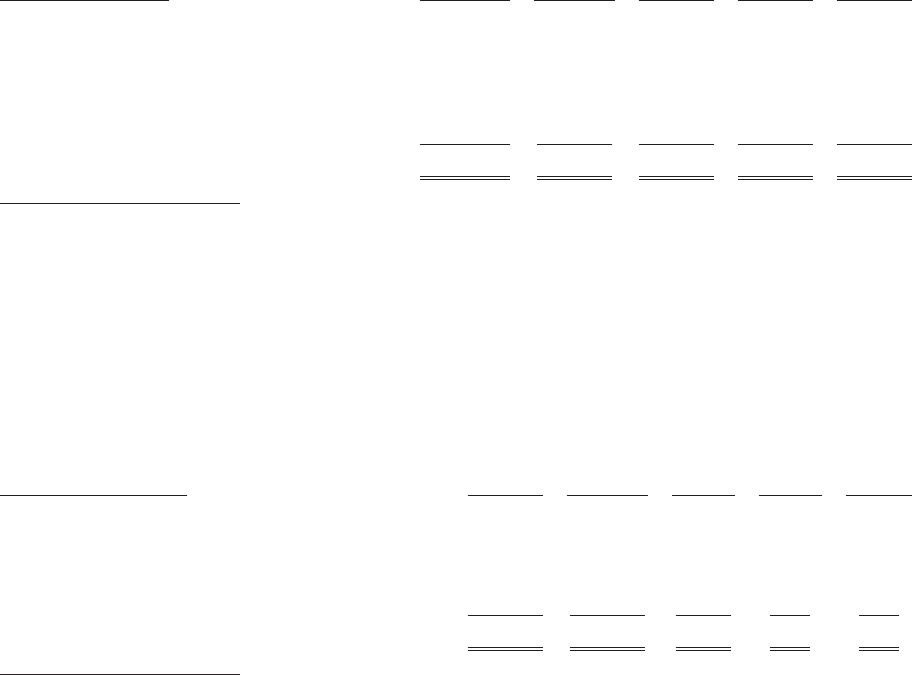

Contractual Obligations

The following chart represents our total contractual obligations and commercial commitments as of

January 30, 2010:

Due in less Due in Due in Due after

Contractual Obligations Total than 1 year 1-3 years 3-5 years 5 years

(dollars in thousands)

Long-term debt(1) ................... $ 307,280 $ 1,079 $ 2,158 $304,043 $ —

Operating leases ..................... 776,285 81,601 158,165 141,329 395,190

Expected scheduled interest payments on

long-term debt .................... 97,188 22,528 44,794 29,866 —

Other long-term obligations(2) .......... 23,462 53 — — —

Total contractual obligations ............ $1,204,215 $105,261 $205,117 $475,238 $395,190

(1) Long-term debt includes current maturities.

(2) Primarily includes pension obligation of $14,164, income tax liabilities and asset retirement

obligations. We made voluntary contributions of $0, $19,918 and $440, to our pension plans in

fiscal 2009, 2008 and 2007, respectively. Future plan contributions are dependent upon actual plan

asset returns and interest rates. See Note 14 of Notes to Consolidated Financial Statements in

‘‘Item 8 Financial Statements and Supplementary Data’’ for further discussion of our pension

plans. The above table does not reflect the timing of projected settlements for our recorded asset

disposal costs of $6,724, income tax liabilities of $2,574 and pension obligation of $14,164 because

we cannot make a reliable estimate of the timing of the related cash payments.

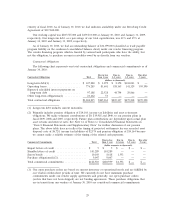

Due in less Due in Due in Due after

Commercial Commitments Total than 1 year 1-3 years 3-5 years 5 years

(dollar amounts in thousands)

Import letters of credit .................... $ 5 $ 5 $ — $ — $ —

Standby letters of credit ................... 103,289 103,289 — — —

Surety bonds ........................... 10,169 8,618 1,551 — —

Purchase obligations(1)(2) .................. 9,047 9,047 — — —

Total commercial commitments .............. $122,510 $120,959 $1,551 $ — $ —

(1) Our open purchase orders are based on current inventory or operational needs and are fulfilled by

our vendors within short periods of time. We currently do not have minimum purchase

commitments under our vendor supply agreements and generally, our open purchase orders

(orders that have not been shipped) are not binding agreements. Those purchase obligations that

are in transit from our vendors at January 30, 2010 are considered commercial commitments.

29