Pep Boys 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

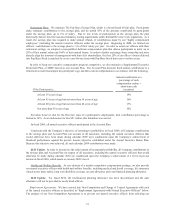

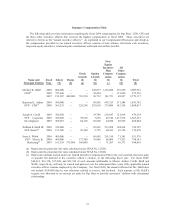

Retirement Plans. We maintain The Pep Boys Savings Plan, which is a broad-based 401(k) plan. Participants

make voluntary contributions to the savings plan, and we match 50% of the amounts contributed by participants

under the savings plan, up to 6% of salary. Due to low levels of participation in the savings plan, the plan

historically did not meet the non-discriminatory testing requirements under Internal Revenue Code regulations. As a

result, the savings plan was required to make annual refunds of contributions made by our “highly compensated

employees” (including the named executive officers) under the savings plan. Beginning in 2004, we limited our

officers’ contributions to the savings plan to ½% of their salary per year. In order to assist our officers with their

retirement savings, we adopted a non-qualified deferred compensation plan that allows participants to defer up to

20% of their annual salary and 100% of their annual bonus. In order to further encourage share ownership and more

directly align the interests of management with that of its shareholders, the first 20% of an officer’s bonus deferred

into Pep Boys Stock is matched by us on a one-for-one basis with Pep Boys Stock that vests over three years.

In order to keep our executive compensation program competitive, we also maintain a Supplemental Executive

Retirement Plan, or SERP, known as our Account Plan. The Account Plan provides fixed annual contributions to a

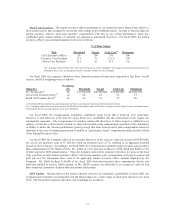

retirement account based upon the participant’s age and then current compensation in accordance with the following:

If the Participant is…

Annual contribution as a

percentage of cash

compensation (salary +

short-term cash

incentive)

At least 55 years of age 19%

At least 45 years of age but not more than 54 years of age 16%

At least 40 years of age but not more than 44 years of age 13%

Not more than 39 years of age 10%

Provided, however, that for the first four years of a participant’s employment, their contribution percentage is

limited to 10%. As an inducement to hire Mr. Arthur, this limitation was waived.

In fiscal 2009, all named executive officers participated in the Account Plan.

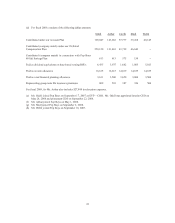

Consistent with the Company’s objective of returning to profitability in fiscal 2009, all Company contributions

to the savings plan and Account Plan (on account of all associates, including the named executive officers) that

would otherwise have been made during calendar 2009 were conditioned upon the Company’s achievement of

threshold performance against the pre-tax income objective established under the Annual Incentive Bonus Plan.

Because this objective was achieved, all such calendar 2009 contributions were made.

2010 Update. In order to incentivize the achievement of incremental profitability, all Company contributions to

the savings plan and Account Plan (in respect of all associates, including the named executive officers) that would

otherwise be made during calendar 2010 are conditioned upon the Company’s achievement of a level of pre-tax

income in fiscal 2010, which meets or exceeds 2009’s level.

Health and Welfare Benefits. As one element of a market-competitive compensation package, we also provide

our named executive officers with health and welfare benefits, including medical and dental coverage, life insurance

valued at one times salary, long term disability coverage, an auto allowance and a tax/financial planning allowance.

2010 Update. For fiscal 2010, the tax/financial planning allowance has been discontinued and the auto

allowance will not be provided to newly hired officers.

Employment Agreements. We have entered into Non-Competition and Change of Control Agreements with each

of the named executive officers as described in “Employment Agreements with Named Executive Officers” below.

The purpose of our Non-Competition Agreements is to prevent our named executive officers from soliciting our