Pep Boys 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

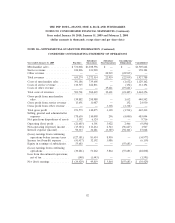

NOTE 15—EQUITY COMPENSATION PLANS (Continued)

Expected volatility is based on historical volatilities for a time period similar to that of the

expected term. In estimating the expected term of the options, the Company has utilized the

‘‘simplified method’’ allowable under the Securities and Exchange Commission, or SEC, Staff

Accounting Bulletin No.107, ‘‘Share-Based Payment’’ through December 31, 2007 and changed to an

actual experience method during fiscal 2008. The risk-free rate is based on the U.S. treasury yield curve

for issues with a remaining term equal to the expected term. The fair value of each option granted

during fiscal 2009, 2008 and 2007 is estimated on the date of grant using the Black-Scholes option-

pricing model and, in certain situations where the grant includes both a market and a service condition

as described more fully below, the Month Carlo simulation model is used. The following are the

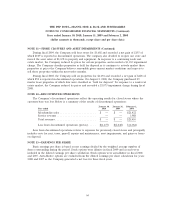

weighted-average assumptions:

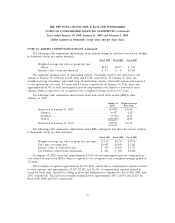

Year ended

January 30, January 31, February 2,

2010 2009 2008

Dividend yield .......................... 2.3% 2.93% 1.79%

Expected volatility ....................... 65% 45% 39%

Risk-free interest rate range:

High ................................. 2.3% 3.2% 5.0%

Low................................. 1.6% 2.7% 3.5%

Ranges of expected lives in years ............ 4-5 3-4 4-5

During fiscal 2009, the Company granted 736,000 stock options with a weighted average grant date

fair value of $1.69. These options have a seven year term and include both a service and a market

appreciation vesting requirement. These options vest over a three year period with a third vesting on

each of the three grant date anniversaries provided the market price of the Company’s stock has

appreciated by a certain amount. From the date of grant, the market price of the Company’s stock

must have appreciated, for at least 15 consecutive trading days, by $2.00 above grant price or more for

536,000 options and by $6.88 above grant price or more for 200,000 options in order to vest. The

Company used a Monte Carlo simulation model to estimate the expected term and is recording the

compensation expense over the service period for each separately vesting portion of the options

granted. During fiscal 2009, the $2.00 market appreciation vesting requirement was satisfied.

The Company reflects in its consolidated statement of cash flows any tax benefits realized upon

the exercise of stock options or issuance of RSUs in excess of that which is associated with the expense

recognized for financial reporting purposes. Approximately $9, $3 and $1,104 are reflected as financing

cash inflows and operating cash outflows in the Consolidated Statement of Cash Flows for fiscal 2009,

2008 and 2007, respectively.

NOTE 16—INTEREST RATE SWAP AGREEMENT

On November 2, 2006, the Company entered into an interest rate swap for a notional amount of

$200,000. The Company has designated the swap as a cash flow hedge on the first $200,000 of the

Company’s $320,000 Senior Secured Term Loan facility. The interest rate swap converts the variable

LIBOR portion of the interest payments to a fixed rate of 5.036% and terminates in October 2013. The

Company did not meet the documentation requirements to apply hedge accounting at inception or as

74