Pep Boys 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

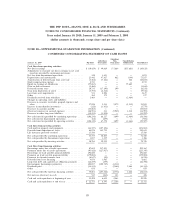

NOTE 17—FAIR VALUE MEASUREMENTS (Continued)

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis:

The Company’s long-term investments, interest rate swap agreements and contingent consideration

are measured at fair value on a recurring basis. The information in the following paragraphs and tables

primarily addresses matters relative to these assets and liabilities.

Cash Equivalents:

Cash equivalents, other than credit card receivables, include highly liquid investments with an

original maturity of three months or less at acquisition. We carry these investments at fair value. As a

result, we have determined that our cash equivalents in their entirety are classified as a Level 1

measure within the fair value hierarchy.

Derivative liability:

The Company has one interest rate swap designated as a cash flow hedge on $145,000 of the

Company’s $149,715 Senior Secured Term Loan facility that expires in October 2013. The Company

values this swap using observable market data to discount projected cash flows and for credit risk

adjustments. The inputs used to value our derivatives fall within Level 2 of the fair value hierarchy.

Contingent Consideration:

The Company has recorded contingent consideration as a result of the acquisition of Florida Tire.

The consideration may be paid to the seller on each six month anniversary of the closing date until the

deferred purchase price is paid in full, subject to acceleration or cancellation clauses. The calculation of

the contingent consideration is based on a weighted average probability scenario that includes

management’s assumptions on expected future cash flows. As a result, we have determined that our

contingent consideration is classified as a Level 3 measure within the fair value hierarchy.

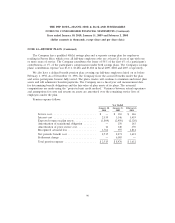

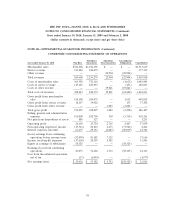

The following table provides information by level for assets and liabilities that are measured at fair

value, on a recurring basis.

Fair Value Fair Value Measurements

at Using Inputs Considered as

January 30,

Description 2010 Level 1 Level 2 Level 3

Assets:

Cash and cash equivalents .......................... $39,326 $39,326

Liabilities:

Other long-term liabilities

Derivative liability(a) .............................. 16,401 16,401

Contingent consideration ........................... 1,660 1,660

(a) included in other long-term liabilities

76