Pep Boys 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

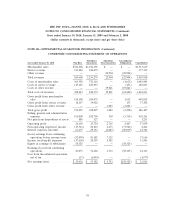

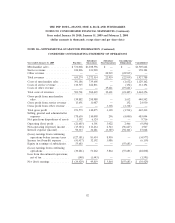

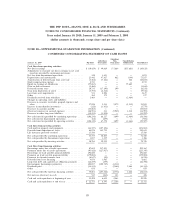

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

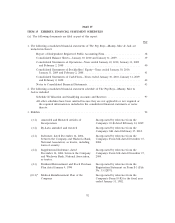

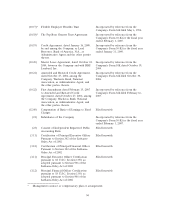

NOTE 20—SUPPLEMENTAL GUARANTOR INFORMATION (Continued)

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Subsidiary

Subsidiary Non- Consolidation

January 30, 2010 Pep Boys Guarantors Guarantors Elimination Consolidated

Cash flows from operating activities:

Net earnings (loss) .......................... $ 23,036 $ 53,582 $ 4,743 $(58,325) $ 23,036

Adjustments to reconcile net earnings (loss) to net cash

(used in) provided by continuing operations:

Net loss from discontinued operations .............. 37 1,040 — — 1,077

Depreciation and amortization ................... 25,405 44,815 682 (373) 70,529

Amortization of deferred gain from asset sales ........ (4,078) (8,620) — 373 (12,325)

Stock compensation expense .................... 2,575 — — — 2,575

Equity in earnings of subsidiaries ................. (58,325) — — 58,325 —

Gain on debt retirement ...................... (6,248) — — — (6,248)

Deferred income taxes ........................ 2,919 10,147 380 — 13,446

Gain from disposition of assets .................. (886) (327) — — (1,213)

Loss from asset impairments .................... 785 2,099 — — 2,884

Dividends received from subsidiary ................ 2,467 — — (2,467) —

Other .................................. 204 141 — — 345

Changes in operating assets and liabilities:

Decrease (increase) in accounts receivable, prepaid

expenses and other ........................ 8,232 520 (957) (620) 7,175

Decrease in merchandise inventories ............... 5,216 1,823 — — 7,039

Decrease in accounts payable ................... (9,640) — — — (9,640)

Decrease in accrued expenses ................... (5,303) (5,999) (2,556) 620 (13,238)

(Decrease) increase in other long-term liabilities ....... (790) 3,174 — — 2,384

Net cash (used in) provided by continuing operations .... (14,394) 102,395 2,292 (2,467) 87,826

Net cash used in discontinued operations ............ (37) (566) — — (603)

Net cash (used in) provided by operating activities ...... (14,431) 101,829 2,292 (2,467) 87,223

Cash flows from investing activities:

Cash paid for property and equipment .............. (18,132) (25,082) — — (43,214)

Proceeds from disposition of assets ................ 4,845 9,931 — — 14,776

Acquisition of Florida Tire, Inc. ................. (2,695) — — — (2,695)

Other .................................. (500) — — — (500)

Net cash used in continuing operations ............. (16,482) (15,151) — — (31,633)

Net cash provided by discontinued operations ......... — 1,762 — — 1,762

Net cash used in investing activities ............... (16,482) (13,389) — — (29,871)

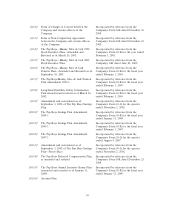

Cash flows from financing activities:

Borrowings under line of credit agreements .......... 88,237 161,467 — — 249,704

Payments under line of credit agreements ............ (96,669) (176,897) — — (273,566)

Borrowings on trade payable program liability ......... 192,324 — — — 192,324

Payments on trade payable program liability .......... (190,155) — — — (190,155)

Long-term debt and capital lease obligation payments .... (11,930) (60) — — (11,990)

Intercompany borrowings (payments) .............. 67,872 (69,064) 1,192 — —

Dividends paid ............................. (6,286) — (2,467) 2,467 (6,286)

Other .................................. 611 — — — 611

Net cash provided by (used in) financing activities ...... 44,004 (84,554) (1,275) 2,467 (39,358)

Net increase in cash ......................... 13,091 3,886 1,017 — 17,994

Cash and cash equivalents at beginning of year ........ 12,753 6,393 2,186 — 21,332

Cash and cash equivalents at end of year ............ $ 25,844 $ 10,279 $ 3,203 $ — $ 39,326

84