Pep Boys 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

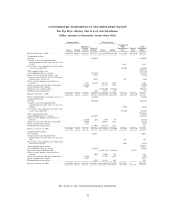

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Pep Boys—Manny, Moe & Jack and subsidiaries (the ‘‘Company’’) consolidated financial

statements have been prepared in accordance with accounting principles generally accepted in the

United States (‘‘U.S. GAAP’’). The preparation of the Company’s financial statements requires the

Company to make estimates and assumptions that affect the reported amounts of assets, liabilities, net

sales, costs and expenses, as well as the disclosure of contingent assets and liabilities and other related

disclosures. The Company bases its estimates on historical experience and on various other assumptions

that management believes to be reasonable under the circumstances, the results of which form the basis

for making judgments about carrying values of the Company’s assets and liabilities that are not readily

apparent from other sources. Actual results could differ from those estimates, and the Company

includes any revisions to its estimates in the results for the period in which the actual amounts become

known.

The Company believes the significant accounting policies described below affect the more

significant judgments and estimates used in the preparation of its consolidated financial statements.

Accordingly, these are the policies the Company believes are the most critical to aid in fully

understanding and evaluating the historical consolidated financial condition and results of operations.

BUSINESS The Company is engaged principally in automotive repair and maintenance and in

the sale of automotive tires, parts and accessories through a chain of stores. The Company currently

operates stores in 35 states and Puerto Rico.

FISCAL YEAR END The Company’s fiscal year ends on the Saturday nearest to January 31.

Fiscal 2009, which ended January 30, 2010, fiscal 2008, which ended January 31, 2009, and fiscal 2007

which ended February 2, 2008 were all comprised of 52 weeks.

PRINCIPLES OF CONSOLIDATION The consolidated financial statements include the accounts

of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have

been eliminated.

CASH AND CASH EQUIVALENTS Cash equivalents include all short-term, highly liquid

investments with an initial maturity of three months or less when purchased. All credit and debit card

transactions that settle in less than seven days are also classified as cash and cash equivalents.

ACCOUNTS RECEIVABLE Accounts receivable are primarily comprised of amounts due from

commercial customers. The Company records an allowance for doubtful accounts based upon an

evaluation of the credit worthiness of its customers. The allowance is reviewed for adequacy at least

quarterly, and adjusted as necessary. Specific accounts are written off against the allowance when

management determines the account is uncollectible.

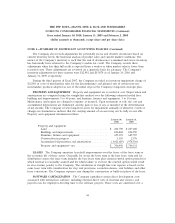

MERCHANDISE INVENTORIES Merchandise inventories are valued at the lower of cost or

market. Cost is determined by using the last-in, first-out (LIFO) method. If the first-in, first-out (FIFO)

method of costing inventory had been used by the Company, inventory would have been $482,022 and

$493,886 as of January 30, 2010 and January 31, 2009, respectively. During fiscal 2009, 2008 and 2007,

the effect of LIFO layer liquidations on gross profit was immaterial.

43