Pep Boys 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

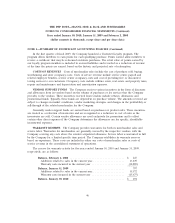

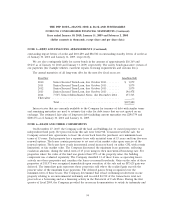

NOTE 6—LEASE AND OTHER COMMITMENTS (Continued)

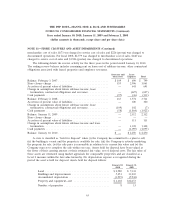

Assets accounted for under the financing method are summarized as follows:

January 30, January 31,

2010 2009

Land ......................................... $ — $1,859

Buildings ...................................... — 2,258

Equipment ..................................... — 2,349

Accumulated depreciation .......................... — (2,829)

Property and equipment—net ....................... $ — $3,637

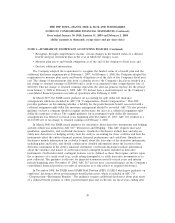

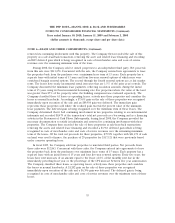

The aggregate minimum rental payments for all leases having initial terms of more than one year

are as follows:

Operating

Year Leases

2010 ................................................... $ 81,601

2011 ................................................... 80,488

2012 ................................................... 77,677

2013 ................................................... 73,189

2014 ................................................... 68,140

Thereafter ............................................... 395,190

Aggregate minimum lease payments ............................ $776,285

Rental expenses incurred for operating leases in fiscal 2009, 2008, and 2007 were $75,265, $77,150

and $69,255, respectively.

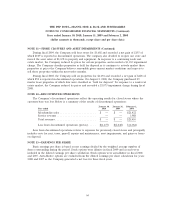

NOTE 7—ASSET RETIREMENT OBLIGATIONS

The Company records asset retirement obligations as incurred and reasonably estimable, including

obligations for which the timing and/or method of settlement are conditional on a future event that

may or may not be within the control of the Company. The obligation principally represents the

removal of leasehold improvements from our stores upon termination of our store leases. The fair

values of obligations are recorded as liabilities on a discounted basis and are accreted over time for the

change in present value. Costs associated with the liabilities are capitalized and amortized over the

estimated remaining useful life of the asset, generally for periods of 15 years.

56