Pep Boys 2009 Annual Report Download - page 82

Download and view the complete annual report

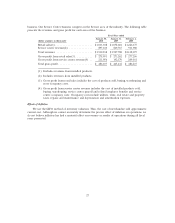

Please find page 82 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sales as discussed above, primarily as a result of an improvement in inventory shrinkage, lower

in-bound freight costs, lower warehousing costs (which declined by 40 basis points to 3.7% of

merchandise sales) and lower store occupancy costs (which declined by 20 basis points to 11.4% of

merchandise sales.) Warehousing costs declined primarily due to lower out-bound freight costs to stores

and occupancy costs declined due to lower building maintenance costs and the elimination of

equipment leasing costs.

Gross profit from service revenue increased to 9.9% for fiscal 2009 from 7.0% in fiscal 2008. Gross

profit from service revenue increased by $12,362,000, or 49.6%. Both the current year and the prior

year gross profit from service revenue included an asset impairment charge related to previously closed

stores of $673,000 and $648,000, respectively. Excluding these adjustments from both years, gross profit

from service revenues increased to 10.1% for fiscal 2009 from 7.1% in the prior year. The increase in

gross profit was primarily due to increased service revenue which resulted in higher absorption of fixed

expenses such as occupancy costs and, to a certain extent, labor costs.

Selling, general and administrative expenses, decreased to 22.5% of total revenues in fiscal 2009

from 25.2% in fiscal 2008. Selling, general and administrative expenses decreased $54,783,000 or 11.4%.

The decrease was primarily due to lower media expense of $21,235,000, lower legal expenses and

professional services fees of $13,300,000, reduced payroll and related expenses of $7,459,000, lower

travel expenses of $2,280,000 and improved general liability claims expense of $1,346,000.

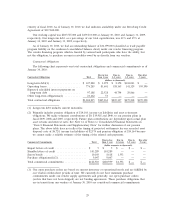

Net gains from the disposition of assets for fiscal 2009 and fiscal 2008 reflect gains of $1,213,000

and $9,716,000, respectively, primarily as a result of sale leaseback transactions. The Company

completed sale leaseback transactions on four stores during fiscal 2009, as compared to sale leaseback

transactions on approximately 70 stores in fiscal 2008.

Interest expense was $21,704,000 in fiscal 2009, a decline of $5,344,000 compared to the prior year.

Fiscal 2009 and 2008 included gains from the retirement of debt of $6,248,000 and $3,460,000,

respectively. Fiscal 2008 also included a $1,172,000 charge for deferred financing costs related to our

revolving credit facility that was replaced. Excluding these items, interest expense declined by

$1,384,000 from fiscal 2008 to fiscal 2009 primarily due to reduced debt levels.

Income tax expense was $13,503,000 or an effective rate of 35.9% for the fiscal 2009 as compared

to an income tax benefit of $6,139,000 or an effective rate of 17.6% for the fiscal 2008. The current

year effective tax rate includes a benefit of $1,200,000 due to the allocation of additional costs to

certain jurisdictions thereby reducing past and future tax liabilities. The prior year effective tax rate was

impacted by the non-deductibility of certain expenses for tax purposes, the recognition of gain for tax

on surrender of life insurance policies and the establishment of a valuation allowance on certain state

net operating losses and credits.

Loss from discontinued operations, net of tax, was $1,077,000 in fiscal 2009 versus $1,591,000, in

fiscal 2008. Fiscal 2009 and 2008 included, on a pre-tax basis, impairment charges of $226,000 and

$1,926,000, respectively.

As a result of the foregoing, we reported net earnings of $23,036,000 for fiscal 2009, an increase of

$53,465,000 from our net loss of $30,429,000 in fiscal 2008. Our basic and diluted earnings per share

were $0.44 as compared to our basic and diluted loss per share of $0.58 in the prior year.

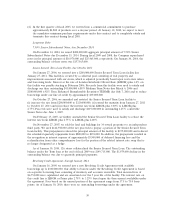

Fiscal 2008 vs. Fiscal 2007

Total revenues for fiscal 2008 decreased 9.8% to $1,927,788,000 compared to $2,138,075,000 for

fiscal 2007. This decrease was primarily due to weaker sales in our retail business stemming from lower

customer counts and the de-emphasis of non-core automotive merchandise. Comparable revenues

decreased by 8.0%, consisting of an 8.4% decrease in comparable merchandise sales and a 6.2%

decrease in comparable service revenue.

24