Pep Boys 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

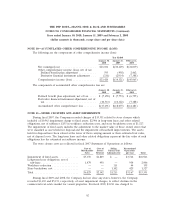

NOTE 8—INCOME TAXES (Continued)

Included in the unrecognized tax benefit of $2,411, $2,458, and $3,847 at January 30, 2010,

January 31, 2009 and February 2, 2008 was $1,331, $1,526, and $2,244 respectively, of tax benefits that,

if recognized, would affect our annual effective tax rate.

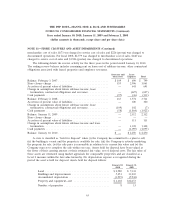

NOTE 9—STOCKHOLDERS’ EQUITY

SHARE REPURCHASE—TREASURY STOCK On September 7, 2006, the Company renewed its

share repurchase program and reset the authority back to $100,000 for repurchases to be made from

time to time in the open market or in privately negotiated transactions through September 30, 2007.

During the first quarter of fiscal 2007, the Company repurchased 2,702,460 shares of Common Stock

for $50,841. This program expired on September 30, 2007.

All of these repurchased shares were placed into the Company’s treasury. A portion of the treasury

shares will be used by the Company to provide benefits to employees under its compensation plans and

in conjunction with the Company’s dividend reinvestment program.

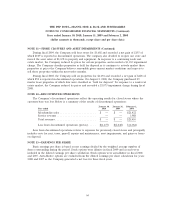

BENEFITS TRUST On January 26, 2010, the Company terminated the flexible employee benefits

trust (the ‘‘Trust’’) that was established on April 29, 1994 to fund a portion of the Company’s

obligations arising from various employee compensation and benefit plans. In accordance with the

terms of the Trust, upon its termination, the Trust’s sole asset, consisting of 2,195,270 shares of the

Company’s common stock, was transferred to the Company in exchange for the full satisfaction and

discharge of all intercompany indebtedness then owed by the Trust to the Company. The termination of

the Trust has no impact on the Company’s consolidated financial statements, except for the

reclassification of the shares from within the shareholders equity section of the Company’s

Consolidated Balance Sheets.

61