Pep Boys 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 32

The Compensation Committee may permit or require a grantee to defer receipt of the payment of the delivery of

shares that would otherwise be due to the grantee in connection with any award of phantom units, subject to the

applicable requirements of Section 409A of the Code.

Qualified-Performance Compensation. If the amendment and restatement of the 2009 Stock Incentive Plan is

approved by our shareholders, the Compensation Committee will be permitted to impose and specify objective

performance goals that must be met with respect to grants of restricted stock, phantom units and dividend equivalents

issued with respect to phantom units intended to qualify as performance-based compensation under Section 162(m)

of the Code to anyone eligible to participate in the 2009 Stock Incentive Plan. The Compensation Committee will

determine the performance periods for the performance goals. Forfeiture of all or part of any such grant will occur if

the performance goals are not met, as determined by the Compensation Committee. Similarly, any dividends or

distributions on performance-based restricted stock (or equivalents of such in connection with phantom units), such

dividends and distributions will be subject to the same vesting and forfeiture provisions applicable to the award of

restricted stock (or phantom units). Prior to, or soon after the beginning of, the performance period, the

Compensation Committee will establish in writing the performance goals that must be met, the applicable

performance periods, the amounts to be paid if the performance goals are met, and any other conditions. Awards

designated as qualified performance-based compensation for purposes of Section 162(m) of the Code may be

decreased at the discretion of the Compensation Committee.

The performance goals, to the extent designed to meet the requirements of Section 162(m) of the Code, will be

based on one or more of the following measures: return on total stockholder equity; earnings per share of Pep Boys

Stock; net income (before or after taxes); earnings before interest, taxes, depreciation and amortization; sales or

revenue targets; return on assets, capital or investment; cash flow; market share; cost reduction goals; budget

comparisons; implementation or completion of projects or processes strategic or critical to our business operation;

measures of customer satisfaction; and/or any combination of, or a specified increase in, any of the foregoing. The

performance goals established by the Compensation Committee may be based upon the attainment of specified levels

of our performance under one or more of the measures described above and may also be based on the performance of

one of our units or divisions or any of our subsidiaries, or measured comparing the performance of any of the

foregoing with other companies based on one or more of the measures described above, or any combination of the

foregoing. The Compensation Committee will determine the objective business criteria upon which the performance

goals are based and the weight to be accorded such goals. Performance goals need not be uniform among

participants.

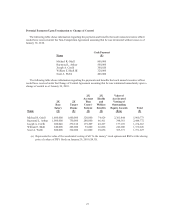

Automatic Grants to Non-Employee Directors. Unless otherwise determined by the Compensation Committee,

awards will be automatically granted, without further action by the Compensation Committee, to each non-employee

director on the Board of Directors, (i) upon their initial election to the Board of Directors and (ii) annually thereafter,

on the date of our Annual Meeting. On the date of each Annual Meeting, each non-employee director will receive

an award with a value of $45,000 in such form as determined by the Compensation Committee, with the value

received calculated utilizing the “RSU Annualized Value” and/or “Option Annualized Value,” each as described

below. On a non-employee director’s initial election to the Board of Directors, such non-employee director will

receive a pro rata portion of the annual award based on a fraction, the numerator of which is the number of days

remaining until the next scheduled Annual Meeting and the denominator of which is 365. Fractional awards will be

rounded up to the nearest whole award. These automatic awards will vest in cumulative installments of one-third on

each of the first three anniversaries of the date of grant. The Compensation Committee has the discretion to make

additional awards under the 2009 Stock Incentive Plan to non-employee directors. “RSU Annualized Value” means,

as of the date an award is granted, the average fair market value of a share of Pep Boys Stock during the immediately

preceding year. “Option Annualized Value” means, as of the date the award is granted, one-third of the RSU

Annualized Value.

Adjustment Provisions. If there is any change in the number or kind of shares of Pep Boys Stock outstanding (i)

by reason of a stock dividend, stock split, spin-off, recapitalization or combination or exchange of shares, (ii) by

reason of a merger, reorganization or consolidation, (iii) by reason of a reclassification or change in par value or (iv)

by reason of any other extraordinary or unusual event affecting the outstanding shares of Pep Boys Stock as a class

without our receipt of consideration, or if the value of shares of Pep Boys Stock is substantially reduced as a result of

a spin-off or our payment of an extraordinary dividend or distribution, the aggregate number of shares of Pep Boys