Pep Boys 2009 Annual Report Download - page 107

Download and view the complete annual report

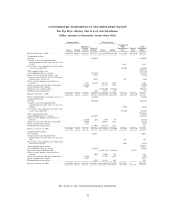

Please find page 107 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

• Recognize, through comprehensive income, certain changes in the funded status of a defined

benefit and post retirement plan in the year in which the changes occur;

• Measure plan assets and benefit obligations as of the end of the employer’s fiscal year; and

• Disclose additional information.

The Company adopted the requirement to recognize the funded status of a benefit plan and the

additional disclosure requirements at February 3, 2007. At February 2, 2008, the Company adopted the

requirement to measure plan assets and benefit obligations as of the date of the Company’s fiscal year

end. The change of measurement date from a calendar year to the Company’s fiscal year resulted in a

net charge to retained earnings of $189,000 and a credit to accumulated other comprehensive loss of

$123,000. This net charge to retained earnings represents the after-tax pension expense for the period

from January 1, 2008 to February 2, 2008. ASC 715 did not have a material impact on the Company’s

consolidated financial position or results of operations after February 2, 2008.

In March 2007, the FASB issued guidance on accounting for split dollar life insurance

arrangements which was included in ASC 718 ‘‘Compensation—Stock Compensation.’’ This ASC

provides guidance on determining whether a liability for the postretirement benefit associated with a

collateral assignment split-dollar life insurance arrangement should be recorded. ASC 718 also provides

guidance on how a company should recognize and measure the asset in a collateral assignment split-

dollar life insurance contract. The original guidance for accounting for split dollar life insurance

arrangements was effective for fiscal years beginning after December 15, 2007. ASC 718 resulted in a

$1,165,000 net of tax charge to retained earnings on February 3, 2008.

In March 2008, the FASB issued guidance for disclosures about derivative instruments and hedging

activities which was included in ASC 815 ‘‘Derivatives and Hedging.’’ This ASC requires increased

qualitative, quantitative, and credit-risk disclosures. Qualitative disclosures include how and why an

entity uses derivatives or hedging activity, how the entity is accounting for these activities and how the

instruments affect the entity’s financial position, financial performance and cash flows. Quantitative

disclosures include information (in a tabular format) about the fair value of the derivative instruments,

including gains and losses, and should contain more detailed information about the location of the

derivative instrument in the entity’s financial statements. Credit-risk disclosures include information

about the existence and nature of credit risk-related contingent features included in derivative

instruments. Credit-risk-related contingent features can be defined as those that require entities, upon

the occurrence of a credit event (e.g., credit rating downgrade), to settle derivative instruments or to

post collateral. The guidance is effective for financial statements issued for fiscal years and interim

periods beginning after November 15, 2008. ASC 815 did not have a material impact on the Company’s

consolidated financial position or results of operations as it only relates to required disclosures.

In December 2008, the FASB issued FASB Staff Position (FSP) 132(R)-1 which gave guidance on

employers’ disclosures about postretirement benefit plan assets, which is included in ASC 715

‘‘Compensation—Retirement Benefits.’’ The guidance requires additional disclosures about plan assets

of a defined benefit pension or other postretirement plan and is effective for fiscal years ending after

49