Pep Boys 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 20

employees or competing with us if they leave Pep Boys of their own volition. As consideration for such restrictive

covenants, the Non-Competition Agreements provide for a severance payment to be made to a named executive

officer if he is terminated by the Company without “cause.” The purpose of the Change of Control Agreements is to

provide an incentive for our officers to remain in our employment and continue to focus on the best interests of Pep

Boys without regard to any possible change of control.

2010 Update. Consistent with the newly-constituted Compensation Committee’s objective of reviewing all

elements of our executive compensation plan, the Compensation Committee will undertake a review of our Non-

Competition and Change of Control Agreements, in light of recent trends in executive compensation with respect to

these types of agreements. The Compensation Committee also plans to consider implementing a “clawback policy”

that would seek to recoup certain incentive based compensation paid to any Officer in certain circumstances.

Tax and Accounting Matters.

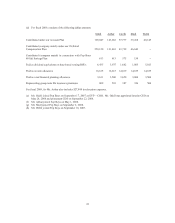

We consider the tax and accounting impact of each type of compensation in determining the appropriate

compensation structure. For tax purposes, annual compensation payable to the named executive officers generally

must not exceed $1 million in the aggregate during any year to be fully deductible under Section 162(m) of the

Internal Revenue Code. The Stock Incentive Plan is currently structured with the intention that stock option grants

will qualify as “performance based” compensation that is not subject to the $1 million deduction limit under Section

162(m). At the 2010 Annual Meeting, the Company is seeking shareholder approval of the performance criteria to

be utilized in awarding performance-based RSUs with the intention that they will similarly qualify. In addition,

bonuses paid to the named executive officers under the Annual Incentive Bonus Plan qualify as “performance based”

compensation that is not subject to the $1 million deduction limit under Section 162(m). Time-based RSUs, which

had been granted in the past, generally do not qualify as “performance based” compensation for this purpose and are

therefore subject to the $1 million deduction limit. In order to compete effectively for the acquisition and retention

of top executive talent, we believe that we must have the flexibility to pay salary, bonus and other compensation that

may not be fully deductible under Section 162(m). Accordingly, the Compensation Committee retains the authority

to authorize payments that may not be deductible under Section 162(m) if it believes that such payments are in the

best interests of Pep Boys and our shareholders. All compensation paid to the named executive officers in fiscal

2009 was fully deductible.

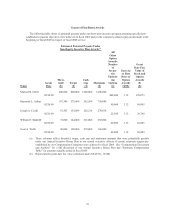

Compensation Committee Report

We have reviewed and discussed the foregoing Compensation Discussion and Analysis with management. Based

upon our review and discussion with management, we have recommended to the Board of Directors that the

Compensation Discussion and Analysis be included in this Proxy Statement and in Pep Boys’ Annual Report on

Form 10-K for the fiscal year ended January 30, 2010 filed with the SEC.

This report is submitted by M. Shân Atkins, Robert H. Hotz and James A. Mitarotonda.