Pep Boys 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

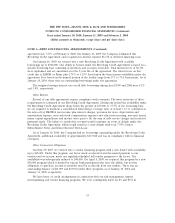

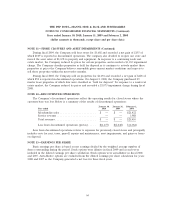

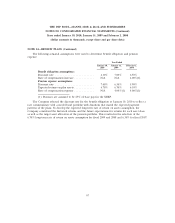

NOTE 11—STORE CLOSURES AND ASSET IMPAIRMENTS (Continued)

merchandise cost of sales, $673 was charged to service cost of sales and $226 (pretax) was charged to

discontinued operations. For fiscal 2008, $2,779 was charged to merchandise cost of sales, $648 was

charged to service cost of sales and $1,926 (pretax) was charged to discontinued operations

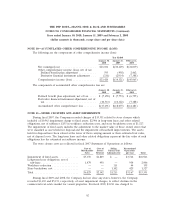

The following details the reserve activity for the three years in the period ended January 30, 2010.

The ending reserve balance includes remaining rent on leases net of sublease income, other contractual

obligations associated with leased properties and employee severance.

Severance and Lease

other costs Expenses Total

Balance, February 3, 2007 ................................ $109 $ 690 $ 799

Store closure charge .................................... 155 2,906 3,061

Accretion of present value of liabilities ....................... — 641 641

Change in assumptions about future sublease income, lease

termination, contractual obligations and severance ............. — (627) (627)

Cash payments ........................................ (97) (36) (133)

Balance, February 2, 2008 ................................ 167 3,574 3,741

Accretion of present value of liabilities ....................... — 300 300

Change in assumptions about future sublease income, lease

termination, contractual obligations and severance ............. (109) 102 (7)

Cash payments ........................................ (58) (1,864) (1,922)

Balance, January 31, 2009 ................................ — 2,112 2,112

Store closure charge .................................... — — —

Accretion of present value of liabilities ....................... — 111 111

Change in assumptions about future sublease income and lease

termination ......................................... — 1,122 1,122

Cash payments ........................................ — (1,095) (1,095)

Balance, January 30, 2010 ................................ $ — $2,250 $ 2,250

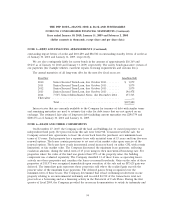

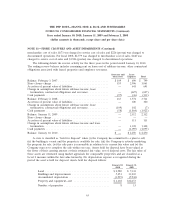

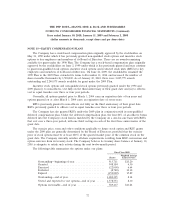

A store is classified as ‘‘held for disposal’’ when (i) the Company has committed to a plan to sell,

(ii) the building is vacant and the property is available for sale, (iii) the Company is actively marketing

the property for sale, (iv) the sale price is reasonable in relation to its current fair value and (v) the

Company expects to complete the sale within one year. Assets held for disposal have been valued at

the lower of their carrying amount or their estimated fair value, net of disposal costs. The fair value of

these assets are estimated using market appraisals for comparable properties and are classified as a

Level 2 measure within the fair value hierarchy. No depreciation expense is recognized during the

period the asset is held for disposal. Assets held for disposal follows:

January 30, January 31,

2010 2009

Land ......................................... $2,980 $ 7,332

Buildings and improvements ........................ 5,453 11,265

Accumulated depreciation .......................... (3,995) (5,944)

Property and equipment—net ....................... $4,438 $12,653

Number of properties ............................. 8 13

63