Pep Boys 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

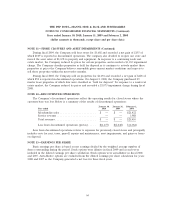

NOTE 7—ASSET RETIREMENT OBLIGATIONS (Continued)

The Company has recorded a liability pertaining to the asset retirement obligation in accrued

expenses and other long-term liabilities on its consolidated balance sheet. The liability for asset

retirement obligations activity from February 2, 2008 through January 30, 2010 is as follows:

Asset retirement obligation at February 2, 2008 ..................... $7,346

Change in assumptions ..................................... (380)

Settlements .............................................. (99)

Accretion expense ......................................... 263

Asset retirement obligation at January 31, 2009 ..................... $7,130

Change in assumptions ..................................... (466)

Settlements .............................................. (154)

Accretion expense ......................................... 214

Asset retirement obligation at January 30, 2010 ..................... $6,724

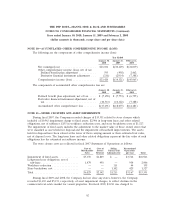

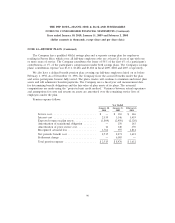

NOTE 8—INCOME TAXES

The provision (benefit) for income taxes includes the following:

Year Ended

January 30, January 31, February 2,

2010 2009 2008

Current:

Federal ............................. $ 398 $ (464) $ (3,646)

State ............................... (511) 1,276 654

Foreign ............................. 149 433 2,187

Deferred:

Federal(a) ........................... 13,820 (8,717) (20,570)

State ............................... 42 754 (3,761)

Foreign ............................. (395) 579 (458)

Total income tax expense/(benefit) from

continuing operations(a) ................. $13,503 $(6,139) $(25,594)

(a) Excludes tax benefit recorded to discontinued operations of $580 in fiscal 2009, $857 in

fiscal 2008 and $2,463 in fiscal 2007.

57