Pep Boys 2009 Annual Report Download - page 108

Download and view the complete annual report

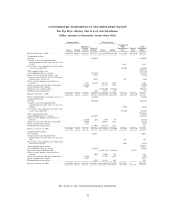

Please find page 108 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

December 15, 2009. The adoption did not have a material impact on the Company’s consolidated

financial position or results of operations as it only amends the required disclosures.

In October 2009, the FASB issued Accounting Standards Update 2009-13 ‘‘Revenue Recognition

(Topic 605)—Multiple-Deliverable Revenue Arrangements a consensus of the FASB Emerging Issues

Task Force,’’ (ASU 2009-13). This update eliminates the residual method of allocation and requires that

consideration be allocated to all deliverables using the relative selling price method. ASU 2009-13 is

effective for material revenue arrangements entered into or materially modified in fiscal years

beginning on or after June 15, 2010. The Company does not believe the adoption of ASU 2009-13 will

have a material impact on its consolidated financial statements.

In January 2010, the FASB issued Accounting Standards Update 2010-06 ‘‘Fair Value

Measurements—Improving Disclosures on Fair Value Measurements’’ (ASU 2010-06). This guidance

requires new disclosures surrounding transfers in and out of level 1 or 2 in the fair value hierarchy and

also requires that in the reconciliation of level 3 inputs, the entity should report separately information

on purchases, sales, issuances or settlements. The increased disclosures should be reported for each

class of assets or liabilities. ASU 2010-06 also clarifies existing disclosures for the level of

disaggregation, disclosures about valuation techniques and inputs used to determine level 2 or 3 fair

value measurements and includes conforming amendments to the guidance on employers’ disclosures

about postretirement benefit plan assets ASC 715. ASU 2010-06 is effective for interim and annual

reporting periods beginning after December 15, 2009 except for the disclosures about purchases, sales,

issuances or settlements in the roll forward activity for level 3 fair value measurements which are

effective for interim and annual periods beginning after December 15, 2010. The adoption of ASU

2010-06 for requirements that are effective December 15, 2009 did not have a material affect on the

Company’s consolidated financial statements. The Company is evaluating the impact on its consolidated

financial statements for those requirements of ASU 2010-06 which are effective December 15, 2010.

NOTE 2—BUSINESS COMBINATIONS

On October 31, 2009, the Company acquired substantially all of the assets (other than real

property) and certain liabilities of Florida Tire, Inc. (‘‘Florida Tire’’), a privately held automotive

service and tire business located in the Orlando Florida area consisting of 10 service locations. The

Company agreed to pay up to $4,418 for Florida Tire including contingent consideration of $1,660. The

Company has completed the purchase accounting for the Florida Tire acquisition and has recorded net

assets of $4,354, including goodwill of $2,549.

50