Pep Boys 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

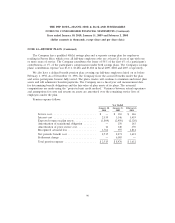

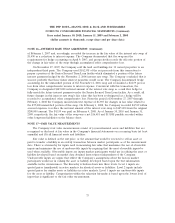

NOTE 14—BENEFIT PLANS (Continued)

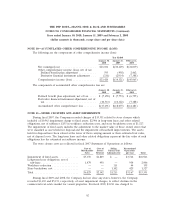

requires that the asset allocation be maintained within certain ranges. The weighted average asset

allocations and asset allocation ranges by asset category are as follows:

Weighted Average Asset Allocations

January 30, January 31, Asset Allocation

2010 2009 Ranges

Total equities ..................................... 48% 44% 45 – 55%

Domestic equities ................................ 32% — 28 – 38%

Non-US equities ................................. 17% — 12 – 22%

Fixed income ..................................... 52% 56% 45 – 55%

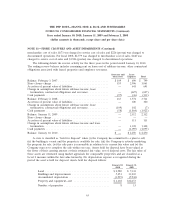

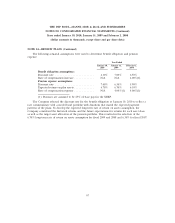

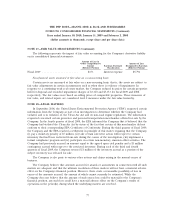

The table below provides the fair values of the company’s pension plan assets at January 30, 2010,

by asset category. The table also identifies the level of inputs used to determine the fair value of assets

in each category (see Note 17 for definition of levels). The significant amount of Level 2 investments in

the table results from including in this category, investments in pooled funds that contain investments

with values based on quoted market prices, but for which the funds are not valued on a quoted market

basis, and fixed income securities that are valued using model based pricing services.

Asset Category Level 1 Level 2 Level 3 Fair Value

Money market fund ................................. $36 — — $ 36

Domestic equities

US Small/Mid Cap Growth .......................... — $ 988 — 988

US Small/Mid Cap Value ............................ — 996 — 996

US Large Cap Passive .............................. — 8,110 — 8,110

Non-U.S. equities

Non-US Core Equity ............................... — 5,279 — 5,279

Fixed income

Long Duration ................................... — 6,702 — 6,702

Long Duration Passive ............................. — 8,538 — 8,538

Guaranteed annuity contracts ........................ — — $1,208 1,208

Total ......................................... $ 36 $30,613 $1,208 $31,857

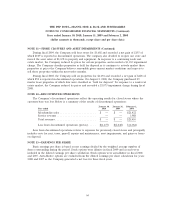

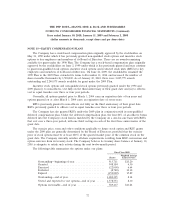

Generally, investments are valued based on information in financial publications of general

circulation, statistical and valuation services, records of security exchanges, appraisal by qualified

persons, transactions and bona fide offers.

Money market funds are valued using a market approach based on the quoted market prices of

identical instruments. These investments are classified within Level 1 of the fair value hierarchy.

Domestic equities, non-US equities, and both Long Duration fixed income securities consist of

collective trust (CT) funds. CTs are comprised of shares or units in commingled funds that are not

70