Pep Boys 2009 Annual Report Download - page 105

Download and view the complete annual report

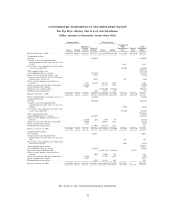

Please find page 105 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 30, 2010, January 31, 2009 and February 2, 2008

(dollar amounts in thousands, except share and per share data)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

ADVERTISING The Company expenses the costs of advertising the first time the advertising

takes place. Gross advertising expense for fiscal 2009, 2008 and 2007 was $52,565, $73,700 and $78,475,

respectively. No advertising costs were recorded as assets as of January 30, 2010 or January 31, 2009.

STORE OPENING COSTS The costs of opening new stores are expensed as incurred.

IMPAIRMENT OF LONG-LIVED ASSETS The Company evaluates the ability to recover

long-lived assets whenever events or circumstances indicate that the carrying value of the asset may not

be recoverable. In the event assets are impaired, losses are recognized to the extent the carrying value

exceeds fair value. In addition, the Company reports assets to be disposed of at the lower of the

carrying amount or the fair market value less selling costs. See discussion of current year impairments

in Note 11, ‘‘Store Closures and Asset Impairments.’’

EARNINGS PER SHARE Basic earnings per share are computed by dividing earnings by the

weighted average number of common shares outstanding during the year. Diluted earnings per share

are computed by dividing earnings by the weighted average number of common shares outstanding

during the year plus incremental shares that would have been outstanding upon the assumed exercise

of dilutive stock options.

ACCOUNTING FOR STOCK-BASED COMPENSATION At January 30, 2010, the Company has

two stock-based employee compensation plans, which are described in Note 15, ‘‘Equity Compensation

Plans.’’ Compensation costs relating to share-based payment transactions are recognized in the financial

statements. The cost is measured at the grant date, based on the calculated fair value of the award, and

is recognized as an expense over the employee’s requisite service period (generally the vesting period of

the equity award).

COMPREHENSIVE LOSS Other comprehensive loss includes pension liability and fair market

value of cash flow hedges.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company may enter into

interest rate swap agreements to hedge the exposure to increasing rates with respect to its certain

variable rate debt agreements. The Company recognizes all derivatives as either assets or liabilities in

the statement of financial position and measures those instruments at fair value.

SEGMENT INFORMATION The Company operates in one industry, the automotive aftermarket,

principally using a Supercenter layout which houses both retail and service centers in one building. The

Company has six operating segments defined by geographic regions which are Northeast, Mid-Atlantic,

Southeast, Central, West and Southern CA. Each segment serves both our DIY and our DIFM lines of

47